Shares in fashion retailer Urban Outfitters (URBN) spiked 12.6% in Tuesday’s after-hours trading after reporting a solid earnings beat. URBN also delivered a far better-than-feared 2H outlook compared to more cautious comments by retail peers.

Specifically, Q2 GAAP EPS of $0.35 beat Street estimates by $0.79, while revenue of $803.27M topped consensus forecasts by $131.58M- despite falling 16.5% year-over-year. Meanwhile gross margin of 29.6% soared past the consensus estimate of 21.3%.

Strong double-digit direct gains drove the top-line surprise (including new customers +76% year-over-year), despite stores being closed for roughly one third of the quarter. Meanwhile total comps were down 13% (Urban Outfitters -8%/ Anthropologie -25%, Free People +11%), although EBIT margins expanded (+50-bps to 8.6%)

“I’m pleased to announce URBN produced solid revenues and profits for the second quarter driven by strength in the digital channel,” said Richard A. Hayne, CEO. “Notably, all brands were profitable and enter the fall selling season with lean inventories and positive momentum,” Hayne concluded.

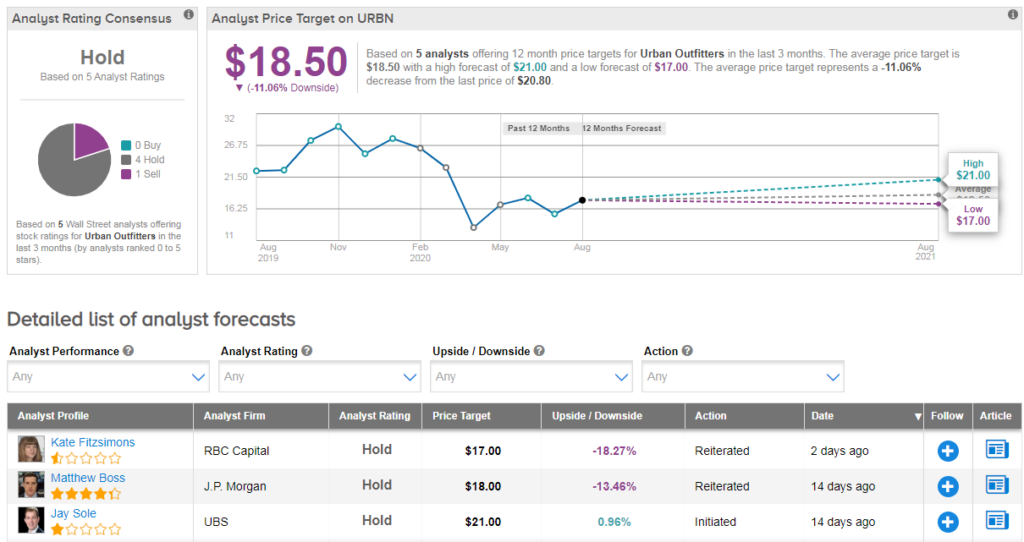

Following the earnings report, RBC Capital analyst Kate Fitzsimons reiterated her hold rating on the stock, while boosting her price target from $17 to $22.

Fitzsimons notes that the URBN team called out digital strong +DD each month, and that traffic (while still negative) in August has improved slightly over July. “Traffic remains challenged (albeit conversion and baskets up), but digital momentum continues” she commented.

Ultimately however, the analyst is staying sidelined, writing: “While much wood to chop into 2H20, we remain neutral given the lack of visibility on URBN’s long-term margin profile associated with a normalized Direct penetration.”

What’s more, the analyst also notes that URBN’s optimism around comp inflections can sometimes not pan out (see 1H19). For 3Q/4Q, she sees total sales (5%)/(2%), with UO at (3%)/(3%), Anthro at (9%)/(4%), and Free People at +13%/+12%. (See URBN stock analysis on TipRanks).

Overall, the Street shares Fitzsimons’ cautious approach with a Hold consensus on Urban Outfitters stock. This is based on 4 recent hold ratings and 1 sell rating. Despite shares already falling 25% year-to-date, the average analyst price target indicates 11% further downside potential lies ahead.

Related News:

Palo Alto Beats 4Q Estimates Spurred By Remote Working Trend

Apple To Open First Online Store In India – Report

Best Buy Sees Sluggish 3Q Sales Growth; Shares Drop