Urban Outfitters, Inc. (URBN) posted solid third-quarter results with earnings and sales both beating expectations. However, the company reported a decline in its in-store sales hampered by COVID-19-related store closures. Shares slumped 12.1% during the extended trading session on November 22.

Urban Outfitters is a lifestyle retail operator with multiple brands under its flagship. Its shares have gained 17.7% over the past year.

Solid Results

The company’s quarterly earnings grew 14.1% year-over-year to $0.89 per share, and meaningfully outpaced analysts’ estimates of $0.84 per share.

Moreover, net sales grew 16.5% at $1.13 billion against the prior-year quarter, surpassing analysts’ estimates of $1.12 billion.

The company witnessed a huge decline in its in-store sales reflected by a mid-single-digit fall in retail store sales due to lower footfall; however, the digital channel sales saw double-digit growth.

Management Comments

Richard A. Hayne, CEO of URBN, said, “I’m pleased to announce our teams produced record Q3 sales and earnings… We are excited that November ‘comp’ sales to date for all brands have accelerated from their Q3 rate.”

See Analysts’ Top Stocks on TipRanks >>

Target Price

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 5 Buys versus 5 Holds. The average Urban Outfitters price target of $43.10 implies 15.6% upside potential to current levels.

Bloggers Weigh In

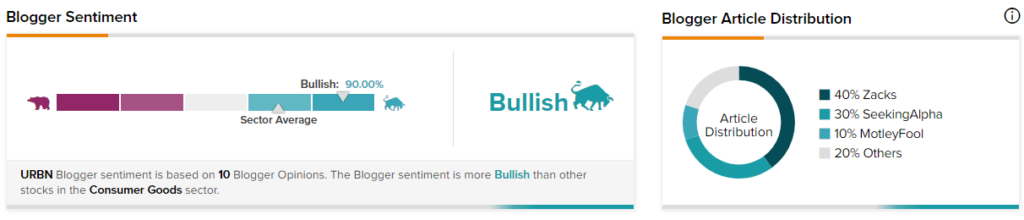

TipRanks data shows that financial blogger opinions are 90% Bullish on URBN, against a sector average of 70%.

Related News:

General Motors Acquires 25% Stake in Pure Watercraft; Shares Rise

Chinese Regulators Penalize Alibaba for Past Deal

AWS to be Cloud Provider for Adidas SAP Workloads