Shares of Upstart Holdings, Inc. (NASDAQ: UPST) declined an eye-watering 17.5% in Thursday’s extended trade after the company posted weak preliminary results for the second quarter of 2022. Shares of this AI-based lending platform closed roughly 2% up at $33.74 in the normal trading session.

Upstart expects its second-quarter revenues to be $228 million, lower than the $295-$305 million range guided in May.

Upstart’s Co-Founder and CEO, Dave Girouard, opined that the company’s second-quarter revenues will reflect the impacts of macroeconomic uncertainties, including inflation and a likely recession, and its measures “to convert loans” into cash.

Meanwhile, Upstart expects a net loss of $27-$31 million in the second quarter, as compared to the $0-$4 million loss estimated earlier. The contribution margin is forecast at 47% in the second quarter (versus the previously stated 45%), and the operating margin is anticipated at (12%).

The company added that a sound cash position and low fixed costs would support its share buyback programs and product investments.

Upstart announced that it will release its second-quarter results after the market closes on August 8. The consensus estimate for UPST’s second-quarter earnings is $0.32 per share. Analysts expect the company to post revenues of $298 million in the second quarter.

A Quick Recap of First-Quarter Performance

In the first quarter of 2022, Upstart’s earnings came in at $0.61 per share, up 15.1% from the consensus estimate of $0.53 per share. Revenues of $310 million also exceeded the consensus estimate of $300 million.

Despite the upbeat results, shares of this $2.8-billion company declined 56% due to the market’s resentment over weak projections for the second quarter.

Wall Street Expresses Disappointment

Following the release of its second-quarter preliminary results, Andrew Boone of JMP Securities downgraded UPST stock to Hold from Buy.

Presently, the company has a Hold consensus rating based on two Buys, eight Holds, and four Sells. UPST’s average price forecast of $41.15 suggests 21.96% upside potential from the current level.

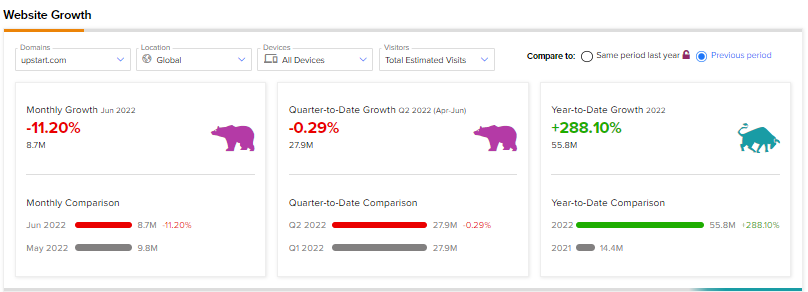

Website Traffic Trends

According to TipRanks, the total visits to UPST’s website declined 11.20% month-over-month in June and 0.29% sequentially in the second of 2022.

The website traffic trend seems to be in sync with the company’s expectation of dismal results for the second quarter of 2022.

Warning Bells

Undoubtedly, Upstart’s prospects are uncertain at the current stage, with its shares almost down 76.7% since the beginning of 2022. For investors already holding UPST, a wait-and-watch approach is likely to work. Meanwhile, it would be wise for potential investors to remain cautious while investing in the stock.

Read full Disclosure