United Parcel Service, Inc. (NYSE: UPS) has reported better-than-expected results for the second quarter of 2022. Its earnings surpassed the consensus estimate by 4.1% and revenues exceeded expectations by 0.5%.

Unfortunately, shares of this $164.2-billion package delivery company slipped 1.8% in the pre-market trading session on Tuesday, at the time of writing. This fall could be because of the market’s disappointment over the company’s weak volumes in the quarter.

Highlights of United Parcel’s Q2 Results

United Parcel’s adjusted earnings were $3.29 per share in the quarter, above the street’s estimate of $3.16 per share. On a year-over-year basis, the bottom line expanded 7.5%, driven by solid top-line performance.

Revenues totaled $24.77 billion in the quarter, surpassing the consensus estimate of $24.65 billion. The top line grew 5.7% from the year-ago quarter on the back of healthy segmental performance. The average revenue per piece was up 11.9% year-over-year to $13.72, while the average daily package volume was down 4.8% year-over-year to 23.1 million.

In the quarter, revenues of the U.S. Domestic segment grew 7.3% year-over-year to $15.49 billion. Also, sales of the International segment increased 5.3% to $5.07 billion, and that of the Supply Chain Solutions segment advanced 0.7% to $4.23 billion.

The adjusted operating profit stood at $3.58 billion in the quarter, and the adjusted operating margin was 14.5%.

UPS’ Projections for 2022

The company anticipates revenues to be $102 billion in 2022. It expects the adjusted operating margin to be 13.7% in the year.

Also, the company intends to reward its shareholders with a dividend of $5.2 billion in 2022. Its share buyback program is now worth $3 billion, up 50% from the earlier $2 billion plan.

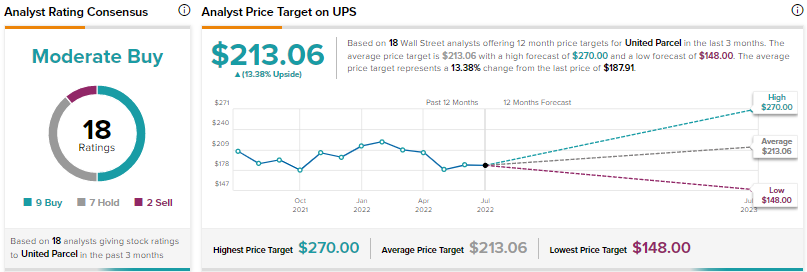

Wall Street Is Both Cautious and Optimistic on United Parcel

On TipRanks, the company has a Moderate Buy consensus rating based on nine Buys, seven Holds, and two Sells. UPS’ average price forecast is $213.06, reflecting upside potential of 13.38% from current levels. Shares of the company have declined 10.5% over the past year.

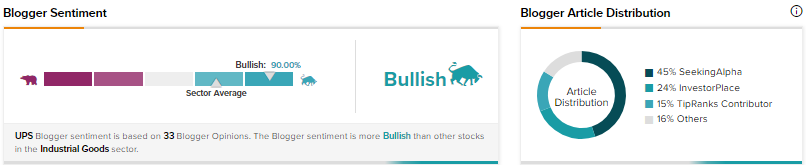

Bloggers Are Bullish on United Parcel

According to TipRanks, bloggers are 90% Bullish on UPS, compared with the sector average of 69%.

Key Takeaways for UPS Stakeholders

From the second quarter results, it is evident that United Parcel’s fundamentals are solid. Despite lower volumes, the company pulled off a healthy top-line result, which was driven by the increase in prices. Revenues projection for 2022 and a 50% increase in the share buyback program were favorable announcements by the company.

Read full Disclosure