UnitedHealth Group Incorporated (NYSE: UNH) has agreed to acquire EMIS Group Plc (LSE: EMIS), a software provider in the healthcare field. The all-cash transaction has been valued at £1.24 billion, or $1.51 billion. Shares of UnitedHealth Group closed at $452.06 on Friday.

The transaction will be executed by Bordeaux UK Holdings II Limited, an associate of Optum Health Solutions (UK) Limited. Optum is a unit of UnitedHealth Group and operates through Optum Health, Optum Insight, and Optum Rx businesses.

Bordeaux UK has offered to pay £1.925 for every share of EMIS Group. The offer price is 49% higher than EMIS Group’s closing share price on Thursday.

At this premium valuation, Optum UK seeks to strengthen its portfolio in the country, especially those governed by the National Health Service (NHS). EMIS, which has expertise in the pharmacy and primary care systems, will help Optum UK to expand its offerings in the IT segment of the primary care market.

Analysts Take

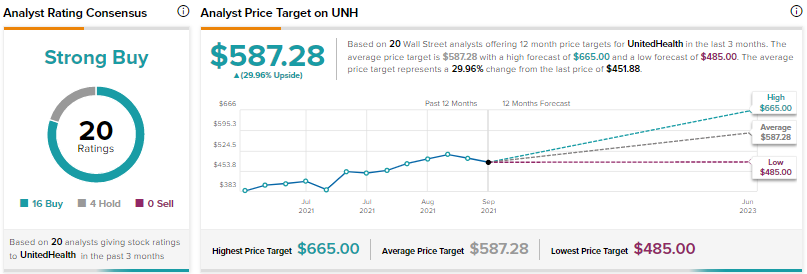

On TipRanks, the American healthcare giant has a Strong Buy consensus rating based on 16 Buys and four Holds. UNH’s average price target is $587.28, suggesting a 29.96% upside potential from the current levels. Over the past year, shares of UNH have increased 13.6%.

Four days ago, Joseph France of Loop Capital gave a Buy rating and a price target of $575 (27.25% upside potential) to UNH in its maiden report on the stock.

Blogger Sentiment

As per the TipRanks tool, the financial bloggers are 96% Bullish on UNH versus the sector average of 70%.

Conclusion

Over time, UnitedHealth Group has strengthened its portfolio and geographical reach through acquisitions. The company has invested $4.82 billion in 2021 and $1.23 billion in Q1 2022 on buyouts.

Upon completion, the EMIS Group buyout will yield long-term benefits despite causing cash depletion and exposure to integration risks in the near term.