On Monday, United Airlines’ (UAL) pilots voted to approve an agreement that would avoid previously announced furloughs of 2,850 pilots. United Airlines shares rose 5.1% yesterday in reaction to the update.

Last week, Reuters had reported that United Airlines and its pilots’ union agreed to delay furloughs until Oct. 30 and were working on a broader deal to protect the jobs of pilots. Delta Air Lines (DAL) also agreed to delay pilot furloughs until Nov. 1 even as the pandemic continues to hurt travel demand.

The Pandemic Recover Letter of Agreement or LOA between United Airlines and its pilots keeps all 13,000 pilots of United Airlines employed and would prevent any pilot from being furloughed at least until June 2021 by allotting fewer flying hours across the pilot base.

The deal also includes a second round of early separation options for all pilots over the age of 50 with 10 years of experience and reduces or terminates the effect of temporary work reductions based on a recovery in passenger demand or other market factors.

Airlines continue to appeal to the government for an extension of the federal aid to the industry as poor travel demand amid the Covid-19 outbreak has put thousands of jobs at risk. The March CARES Act provided $25 billion of aid to the industry so as to support the jobs of airline employees through the end of September.

United Airlines’ pilots have avoided furloughs with Monday’s agreement but the jobs of about 12,000 frontline employees continue to be at risk if the federal aid is not extended. For 3Q, United Airlines expects passenger demand to be down 70% and revenue down 85% Y/Y.

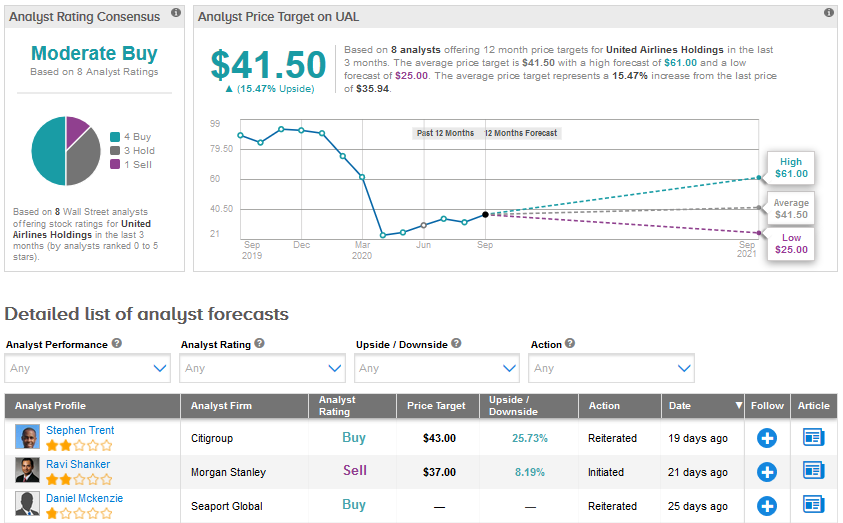

Recently, Citigroup analyst Stephen Trent lowered his price target for United Airlines to $43 from $47 but maintained a Buy rating after the carrier announced reduced capacity and revenue forecasts for the third quarter. The analyst also lowered his 2020 and 2021 earnings estimates.

The airline’s “top-line weakness appears consistent with Citi’s view on the risk of a sequential, post-Labor Day dip,” the analyst writes, “and dovetails with expected revenue weakness on key routes.” (See UAL stock analysis on TipRanks)

The Street has a cautious Moderate Buy consensus for United Airlines based on 4 Buys, 3 Holds and 1 Sell rating. The stock has plunged 59% year-to-date. The average analyst price target of $41.50 indicates that it could rise over 15% in the months ahead.

Related News:

Delta To Incur Up To $2.5B In Jet Retirement Charges In 3Q

American Airlines Inks $5.5B US Treasury Loan; Shares Rise

JetBlue Slashes Q3 Capacity Guidance Amid The Current Crisis