United Airlines Holdings Inc (UAL) warned that it sees travel bookings weakening as the recent resurgence in coronavirus infections and the related new restrictions imposed by some U.S. states are curtailing demand.

The news sent shares down 7.6% to $32.58 at the close on Tuesday. In a Town Hall for its operational employees, the ailing airline said that consolidated capacity for June was down about 88% year-over-year and that July capacity is expected to be down about 75% year-over-year.

Looking ahead to the peak summer season, management also indicated that capacity for August will probably be down about 65% year-over-year. In addition, United said that it will be making adjustments to scale back its schedule plans announced earlier this month, due to reduced demand to destinations experiencing a surge in COVID-19 cases and new quarantine requirements or other travel restrictions. The U.S. airline had said on July 1 that it was planning to add about 25,000 domestic and international flights in August.

In light of the recent spike in coronavirus cases, United will continue to proactively evaluate and cancel flights on a rolling 60-day basis until it sees signs of a recovery in demand. However, the airline expects demand to remain suppressed until a treatment or vaccine for COVID-19 is available.

The airline’s management does not see the COVID-19 recovery to follow a linear path, as illustrated by recent booking and demand trends, and said that consolidated capacity through the end of 2020 is expected to be generally consistent with that of August.

United shares have lost 63% of their value this year as the lockdown mandates tied to the outbreak of the coronavirus pandemic brought travel demand to a stand-still. The stock saw some recovery last month fueled by a broad stock market rally amid early signs of what had looked like a gradual relaxation of some of the coronavirus-related lockdown restrictions.

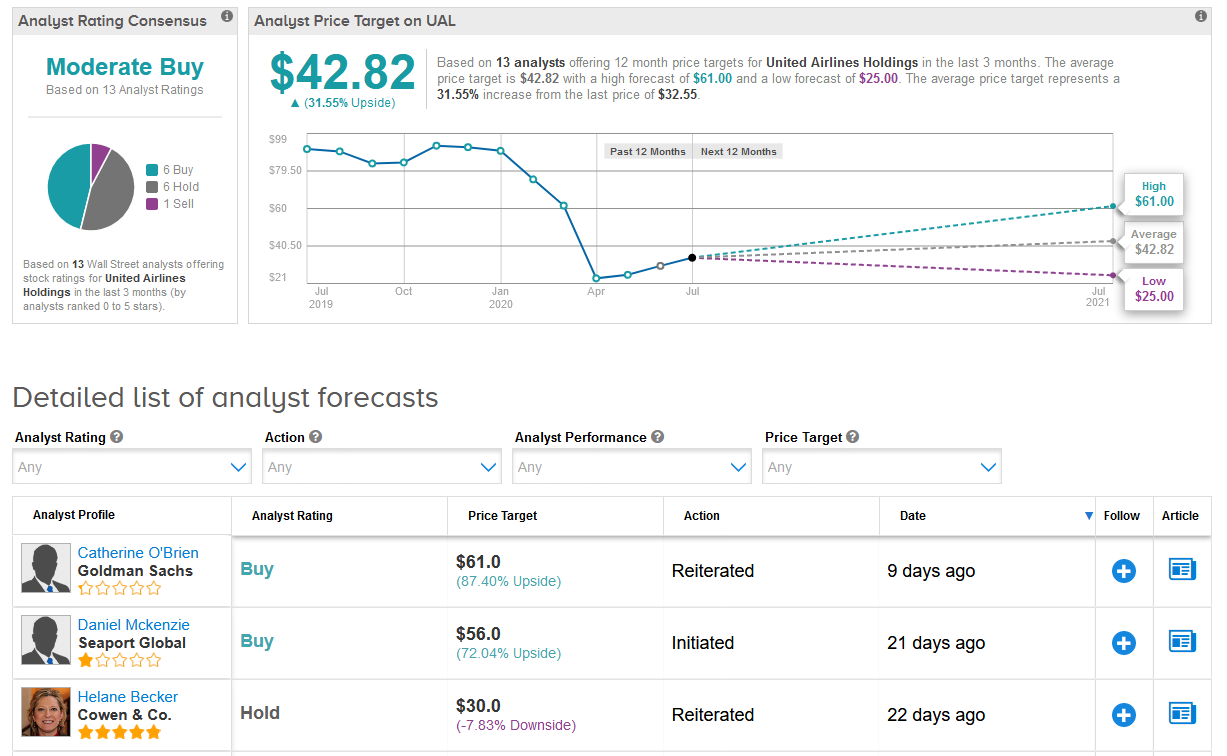

Goldman Sachs analyst Catherine O’Brien at the end of last month raised the airline’s price target to $61 (87% upside potential) from $40 and maintained a Buy rating on the shares, saying that improving trends in markets that have reopened are encouraging.

O’Brian added that airlines have made better progress to reduce cash burn over the last several months than expected. However, the analyst cautioned that current traffic trends are still below what she had previously forecast for exiting the June quarter and that the resurgence of COVID-19 in some areas of the U.S. adds uncertainty around potential further travel restrictions.

For now, it looks like Wall Street analysts are divided on the airline’s stock. The Moderate Buy analyst consensus breaks down into 6 Buys versus 6 Holds and 1 Sell. Meanwhile, the $42.82 average price target puts the upside potential at 32% in the coming 12 months. (See United Airlines stock analysis on TipRanks).

Related News:

Avolon Cancels 27 Of Boeing 737 Max Aircraft Order

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest