Unilever (GB:ULVR) recently announced its results for H1 2022. It posted an underlying sales growth of 8.1%. The turnover increased by 14.9% to €29.6 Billion. The operating profits during this period were up 1.7% at €4.5 Billion.

In 2022, the company expects to exceed its sales growth guidance and deliver growth of more than 6.5%. The full-year operating margin remains in the range of 16%-17%, as previously forecasted.

Unilever’s chief executive, Alan Jope, said, “Unilever has delivered a first half performance which builds on our momentum of 2021, despite the challenges of high inflation and slower global growth. The challenges of inflation persist and the global macroeconomic outlook is uncertain, but we remain intensely focused on operational excellence and delivery in 2022 and beyond.”

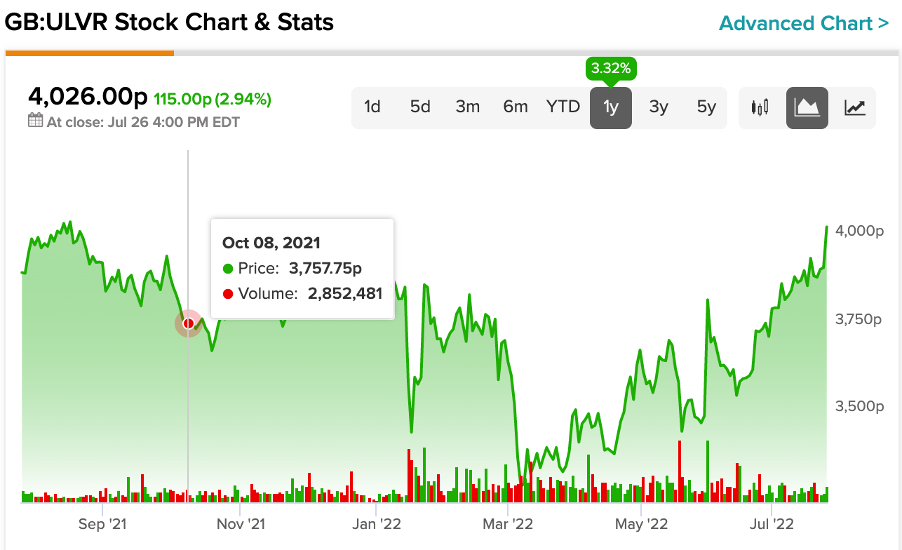

The market reacted positively to the news, and the share prices jumped around 3% after the news. Overall, Unilever’s stock has managed to stay within the green zone with a 3.32% return last year.

Facing the heat of inflation, still focused on growth

With a diverse product portfolio, Unilever is one of those companies that can raise prices while experiencing only a minor drop in sales. So far, the company is managing this well and the customers are still loyal.

Overall, the company increased its prices by 9.8% and saw a downfall of just 1.6% in its volumes.

However, investors remain cautious as, with the cost of living crisis tightening spending in the UK, how long will they be able to pay the increased prices?

Unilever is prepared to deal with rising costs and expects net material inflation to remain high this year at €4.6 billion. Despite this, the company is focused on improving its margins in 2023 and 2024 with a balanced approach toward pricing and savings.

View from the city

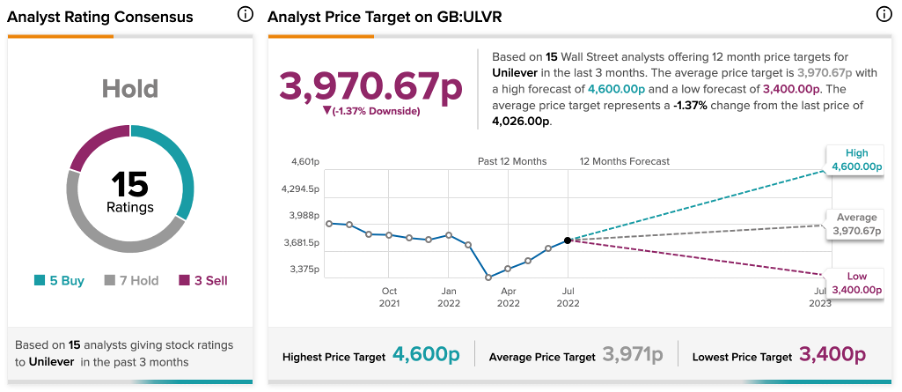

According to TipRanks’ analyst rating consensus, Unilever stock has a Hold rating. The rating is based on eight Hold, four Buy, and three Sell ratings from analysts.

The average Unilever price target is 3,970.6p, which indicates a fall of 1.4% from the current price. The analyst price targets range from a low of 3,400p to a high of 4,600p.

Outlook

Unilever expects its medium-term outlook to be uncertain and volatile. Yet the company remains optimistic about achieving its guidance numbers and improving its overall profitability.