Tesla Motors (TSLA) makes electric vehicles and has released several car models on the market. It also runs a renewable energy business through which it sells solar panels and energy storage products.

For Q4 2021, Tesla reported a 65% year-over-year jump in revenue to $17.7 billion and exceeded the consensus estimate of $16.4 billion. It posted adjusted EPS of $2.54, which rose from $0.80 in the same quarter the previous year and beat the consensus estimate of $2.26.

With this in mind, we used TipRanks to take a look at the risk factors for Tesla.

Risk Factors

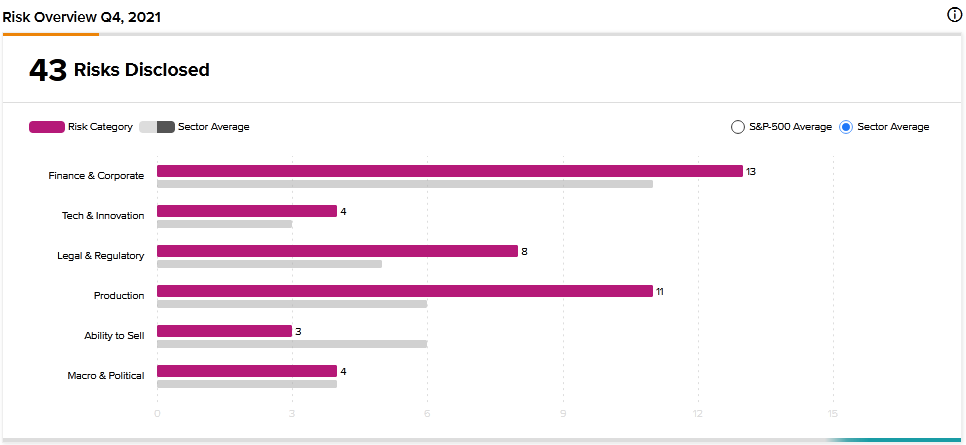

According to the new TipRanks Risk Factors tool, Tesla’s top risk category is Finance and Corporate, which contains 13 of the total 43 risks identified for the stock. Production and Legal and Regulatory are the next two major risk categories, with 11 and 8 risks, respectively. Tesla has recently added one new risk factor and updated several previously outlined risks.

Tesla’s newly added risk factor falls under the Legal and Regulatory category and relates to environmental, social, and governance (ESG) issues. The company says that investors are increasingly focusing on corporate ESG practices across industries. While Tesla’s mission is to accelerate the transition to sustainable energy, the company cautions that it may not meet investors’ ESG expectations. If its ESG practices fall short of expectations, Tesla warns that its costs may rise, attracting and retaining qualified workers may become more difficult, and its reputation and business may be harmed.

In an updated risk factor, Tesla cautions about its reliance on Elon Musk, describing him as the company’s CEO and Technoking. While Musk’s services are critical to Tesla, he does not devote all his time and attention to the electric automaker. For example, Musk is also the CEO of Space Exploration Technologies Corp., a startup that builds space launch vehicles.

In another updated risk factor, Tesla reminds investors of the potential adverse consequences of it being in debt. It says that it finished 2021 with about $5.4 billion in debt. It explains that holding debt may make it more vulnerable to adverse economic conditions. Further, Tesla says that its ability to service the debt depends on the performance of its business, which is subject to many factors beyond its control.

The company cautions that it may not generate sufficient cash flow to service debt and fund capital expenditures. While the company may resort to remedies such as selling assets or seeking refinancing to cope with the debt, it cautions that such alternative measures may not be successful. As a result, Tesla may not only default on its debt obligations but may also have to delay or reduce capital investments.

Tesla’s stock has declined about 23% year-to-date. Tesla is among the most prominent EV stocks, according to TipRanks.

Analysts’ Take

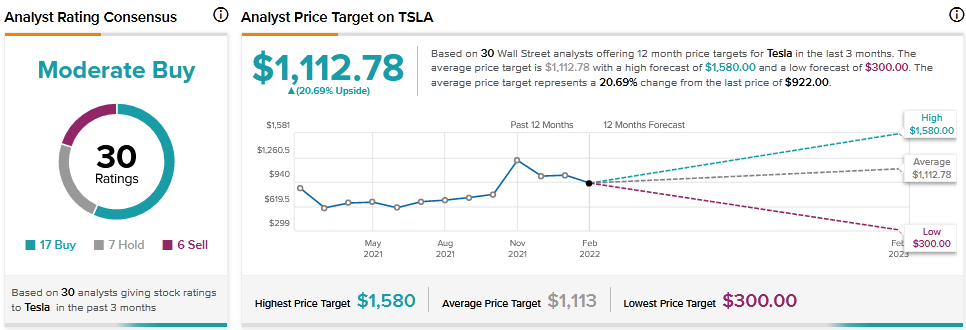

Daiwa Securities analyst Jairam Nathan recently maintained a Hold rating on Tesla stock but cut the price target to $980 from $1,150. Nathan’s new price target suggests 6.29% upside potential. The analyst is concerned about Tesla’s ability to sustain its EV leadership, noting a lack of new products while rivals have continued to launch new electric vehicles.

Consensus among analysts is a Moderate Buy based on 17 Buys, 7 Holds, and 6 Sells. The average Tesla price target of $1,112.78 implies 20.69% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Doximity Jumps Over 8% on Upbeat Q3 Results

Uber Sends Driver Alerts; Partners with VEMO to Add 250 EVs – Report

Inside Spotify’s Newly Added Risk Factors