California-based Skyworks Solutions (SWKS) is a multinational semiconductor company. Its technology is used in cellular infrastructure, automotive, defense, connected home, and medical markets. In an expansion move, Skyworks recently acquired Silicon Laboratories’ (SLAB) infrastructure and automotive business for $2.75 billion.

With this in mind, let us take a look at the company’s latest financial performance and understand its newly added risks. (See Insiders’ Hot Stocks on TipRanks)

Q4 Financial Results

Skyworks’ fourth-quarter revenue jumped 37% year-over-year to $1.31 billion, surpassing the consensus estimate of $1.30 billion. Further, it posted adjusted earnings of $2.62 per share against $1.85 per share in the same quarter last year. The consensus estimate for the same stood at $2.53 per share.

Skyworks ended the fourth quarter with $882.9 million in cash. It plans to distribute a quarterly cash dividend of $0.56 per share on December 14.

For the first-quarter of Fiscal Year 2022, Skyworks anticipates revenue in the band of $1.48 billion to $1.53 billion and adjusted earnings of $3.10 per share. (See Skyworks stock charts on TipRanks).

Risk Factors

According to the new TipRanks’ Risk Factors tool, SWKS’ main risk categories are Finance & Corporate and Production, which account for 26% each of the total 31 risks identified for the stock. The company recently added three new risks under the Finance and Corporate risk category.

Skyworks tells investors that it may not achieve the anticipated benefits of the recently acquired Silicon Labs business. It mentions that integrating the business could prove more difficult than anticipated and increase the costs associated with the acquisition.

The company has informed investors that it incurred significant debt to fund the acquisition of the Silicon Labs unit. It mentions a $1 billion term loan obtained from a group of lenders led by JPMorgan Chase (JPM). It also issued $1.5 billion in interest-bearing notes, maturing between 2023 and 2031. Further, it has entered into a revolving credit agreement for $750 million.

Skyworks cautions that servicing the debts could reduce the funds available for future acquisitions, capital expenditures, or working capital. The company warns that the debt burden may put it at a competitive disadvantage by reducing its flexibility to adjust to changing economic conditions. It also wants investors to bear in mind that the debts could adversely affect its credit rating.

Skyworks has also cautioned investors that the terms of the debt agreements may limit its ability to obtain future credit financing or merge with another companies. It warns that any failure to comply with these terms could result in a default, which would adversely affect its business, financial condition, and stock price.

Analysts’ Take

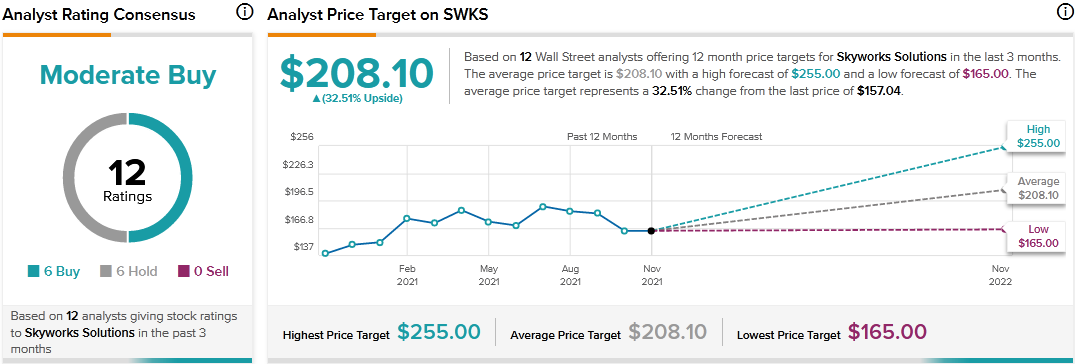

Following Skyworks’ fourth-quarter earnings report, B.Riley Financial analyst Craig Ellis maintained a Buy rating on the stock but lowered the price target to $210 from $245.

Consensus among analysts is a Moderate Buy based on 6 Buys and 6 Holds. The average Skyworks price target of $208.10 implies 32.51% upside potential to current levels.

Related News:

Scotiabank Donates C$400K to Professional Women’s Group Program

New CIBC Costco MasterCard to Offer More Cash Back

Lightspeed Holds First Capital Markets Day