Scientific Industries, Inc. (SCND) provides life sciences tools and develops digitally simplified bioprocessing products. It recently delivered robust top-line growth for Fiscal 2021.

Let’s look at SCND’s Fiscal 2021 financials and understand what has changed in its key risk factors that investors should know.

Net revenue increased 26% year-over-year to $9.8 million, owing to higher net sales of Benchtop Laboratory Equipment operations partly related to COVID-19 associated research and testing.

Despite this sales growth, an increase in operating expenses of SCND’s Bioprocessing systems operations and a net loss for discontinued operations resulted in net loss per share of the company widening to $1.15 per share from $0.46 per share a year ago. (See Insiders’ Hot Stocks on TipRanks)

During the fourth quarter, SCND acquired German technology company Aquila Biolabs and started integrating it into SCND’s Bioprocessing Systems Operations. The move helped SCND to create digitally simplified bioprocessing — a new category in bioprocessing.

The Chairman of SCND, John Moore, said, “We are now focused on expanding the bioprocessing customer base beyond the existing 250 aquila customers and investing strategically in the product roadmap which we believe will deliver even more compelling value to our customers.

“The smooth integration of Aquila has been our primary focus during the past quarter and cross-training of our sales forces. We are investing to integrate the Aquila product line with our optical dissolved oxygen and pH sensors which we expect to be complete in fiscal 2022.”

Now, let’s have a look at what’s changed in the company’s key risk factors profile.

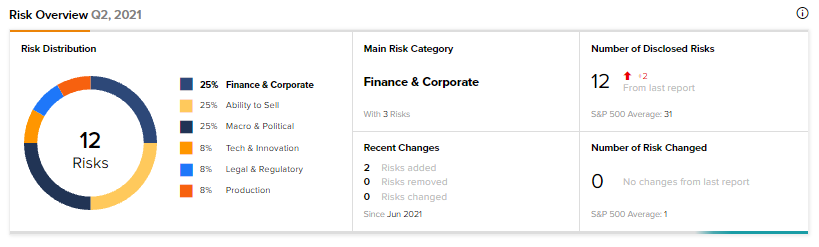

According to the new Tipranks’ Risk Factors tool, SCND’s top three risk categories are Finance & Corporate, Ability to Sell, and Macro & Political, which account for 25% each to the total 12 risks identified. In the recent annual report, the company has added two new risk factors.

Under the Finance & Corporate risk category, SCND highlights that it may face challenges in the integration of Aquila or future acquisitions with its current operations. Further, this process of integration may result in an interruption of normal business operations.

Under the Macro & Political risk category, SCND notes that while almost all of its sales are in U.S. dollars, after the acquisition of Aquila it is exposed to foreign exchange rate risk, which is both transactional and translational.

The Macro & Political risk factor’s sector average is at 19%, compared to SCND’s 25%. Shares have lost 14.3% so far this year.

Related News:

PNC Financial Exceeds Q3 Revenue Expectations; Shares Fall 1.7%

BancorpSouth & Cadence Merger Approved by FDIC

Nokia Chosen by T-2 Slovenia in Exclusive 5-year 5G Deal