Louisiana-based Lumen Technologies (LUMN), formerly known as CenturyLink, provides communications services to residential and business customers. It recently partnered with Cisco (CSCO) to offer collaboration solutions to businesses adopting remote and hybrid work environments.

With this in mind, we used TipRanks to take a look at the latest financial performance and newly added risk factors for Lumen. (See Insiders’ Hot Stocks on TipRanks)

Q3 Financial Results

Lumen reported revenue of $4.89 billion for Q3 2021, compared to the consensus estimate of $4.9 billion. Revenue was $5.2 billion in the same quarter last year. It posted adjusted EPS of $0.49 versus $0.35 in the same quarter last year and beat the consensus estimate of $0.38.

Lumen ended the quarter with $635 million in cash. The company plans to distribute a quarterly cash dividend of $0.25 per share on December 10. The company recently completed its previously announced $1 billion stock repurchase program. (See Lumen Technologies stock charts on TipRanks).

Risk Factors

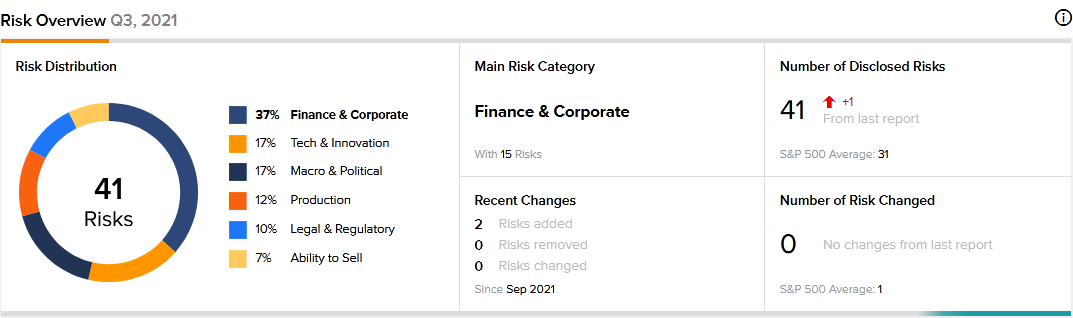

According to the new TipRanks Risk Factors tool, Lumen’s main risk category is Finance and Corporate, accounting for 37% of the total 41 risks identified for the stock. The company recently updated its profile with two new risk factors.

In a newly added Finance and Corporate risk factor, Lumen cautions that its planned divestitures may not go as expected. The company agreed to sell its Latin American business to Stonepeak for $2.7 billion. It concurrently entered into a strategic arrangement with Stonepeak that would allow it to continue to serve shared customers in the region. The transaction is expected to close in the first half of 2022. Separately, Lumen has agreed to sell some of its local operations in 20 states to Apollo Global Management (APO) for $7.5 billion. It expects to close the transaction in the second half of 2022. However, the company cautions that the divestitures will reduce its future cash flows and may not deliver the anticipated benefits.

Lumen has introduced a new Legal and Regulatory risk factor related to the COVID-19 vaccine mandate. The company tells investors that starting December 8, all U.S. employees will need to be vaccinated against COVID-19 or risk losing their jobs, as it complies with President Joe Biden’s vaccine mandate. Some employees may be exempt on medical or religious grounds. But Lumen cautions that the vaccine mandate may result in labor shortages, which could, in turn, have a material adverse effect on its operating results or financial condition.

The Finance and Corporate risk factor’s sector average is 40%, compared to Lumen’s 37%. The Legal and Regulatory risk factor’s sector average is 17%, compared to Lumen’s 10%. Lumen’s stock has gained about 26% since the beginning of 2021.

Analysts’ Take

Following Lumen’s Q3 earnings report, Morgan Stanley analyst Simon Flannery reiterated a Sell rating on Lumen stock and lowered the price target to $10 from $11. Flannery’s reduced price target suggests 18.57% downside potential.

Consensus among analysts is a Hold based on 1 Buy, 1 Hold, and 1 Sell. The average Lumen Technologies price target of $12.33 implies the stock is fully valued at current levels.

Related News:

Mimecast Agrees to be Acquired for $5.8B; Shares Rise

Uber Launches Holiday Hub; Street Says Buy

Cognizant to Bolster Customer Software Solution with Devbridge Buyout