Logitech (LOGI) manufactures computer peripherals such as keyboards, mice, webcams, speakers, and headsets. The Swiss company has been in business since 1981.

For its Fiscal Q3 2022 ended December, Logitech reported a 2% decline in revenue to $1.63 billion, which exceeded the consensus estimate of $1.27 billion. It posted adjusted EPS of $1.55, which declined from $2.45 in the same quarter in the previous year but still beat the consensus estimate of $1.10. The company ended the quarter with $1.36 billion in cash.

Logitech is among the highest yielding stocks in its category, currently offering a dividend yield of 1.16% versus the sector average of 0.69%.

For Fiscal 2022, Logitech now anticipates revenue to grow between 2% and 5%. It previously expected revenue to decline as much as 5%.

With this in mind, we used TipRanks to take a look at the risk factors for Logitech.

Risk Factors

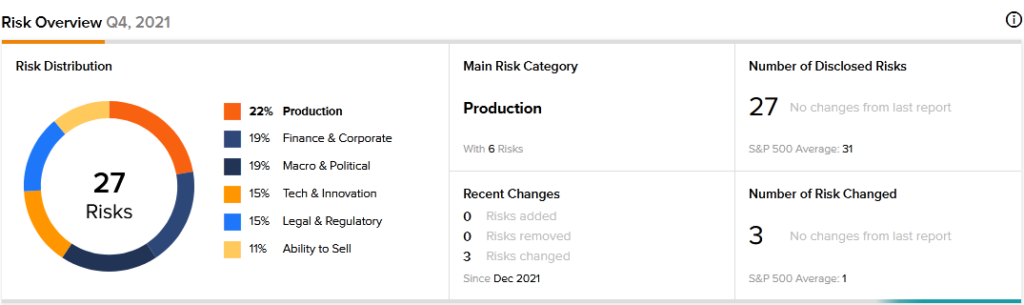

According to the new TipRanks Risk Factors tool, Logitech’s main risk category is Production, representing 22% of the total 27 risks identified for the stock. Finance and Corporate and Macro and Political are the next two major risk categories, each accounting for 19% of the total risks. Logitech has recently updated a number of its risk factors across the board to emphasize the various challenges it faces.

The company reminds investors that its business may be adversely impacted by changes to trade agreements. It mentions that the U.S. government has sought to renegotiate certain trade agreements and has imposed tariffs on some imports. In addition to being pressed to comply with restrictive U.S. trade regulations, Logitech explains that it may also be impacted by retaliatory measures taken by other countries, including China, in response to U.S. actions.

While it cannot predict future adjustments to the global trade agreements, Logitech warns that changes and tariffs could adversely affect its operating results and financial condition. Logitech explains that it has invested heavily in manufacturing facilities in China and other Asian countries.

Logitech informs investors that data protection regulations are tightening around the world, increasing the burden on the companies that handle customers’ personal data. It has cited the European Union’s GDPR and California’s data privacy laws as examples. Further complicating matters is that regulations may vary across jurisdictions. Logitech cautions that increasingly complex data protection regulations may increase its costs, expose it to financial penalties, or generate negative publicity that could adversely affect its business.

The Production risk factor’s sector average is 15%, compared to Logitech’s 22%. Logitech shares have declined about 4% year-to-date.

Analysts’ Take

Following Logitech’s Q3 earnings report, Loop Capital analyst Ananda Baruah reiterated a Hold rating on Logitech stock with a price target of $80, which suggests 2.26% downside potential from the current price. Baruah commented that Logitech’s boosted Fiscal 2022 outlook may still be conservative as the company looks to be in a great position.

Consensus among analysts is a Moderate Buy based on 4 Buys, 3 Holds, and 1 Sell. The average Logitech price target of $92.52 implies 13.04% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Church & Dwight Posts Upbeat Q4 Results, Shares Rise 4.4%

Bristol Myers Squibb Gets Positive CHMP Opinion for Breyanzi; Shares Gain

Netflix CEO Hastings Buys $20M of Shares in the Dip