Danaher (DHR) is an American science and technology company with a global footprint. Its solutions address complex challenges and help improve quality of life. (See Analysts’ Top Stocks on TipRanks)

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factor.

Q3 Financial Results

Danaher reported revenue of $7.23 billion for its Fiscal 2021 third-quarter ended October 1. That increased from $5.88 billion in the same quarter last year and exceeded the consensus estimate of $7 billion. It posted adjusted EPS of $2.39, compared to $1.72 in the same quarter last year, and beat the consensus estimate of $2.15. (See Danaher stock charts on TipRanks).

The company plans to distribute a quarterly cash dividend of $0.21 per share on October 29.

Corporate Updates

Danaher has completed the acquisition of Aldevron for $9.6 billion in cash. Aldevron serves biotechnology and pharmaceutical customers in areas such as research and clinical programs. Its acquisition is expected to expand Danaher’s life sciences business and bolster its capabilities in the genomic medicine field.

In its 2021 sustainability report, Danaher says it has become a signatory to the United Nations Global Compact. It says that demonstrates its commitment to human rights, anti-corruption, labor, and the environment. Additionally, the company has launched community impact and sustainable supply chain programs.

Risk Factors

Danaher carries 44 risk factors, according to the new TipRanks Risk Factors tool. Since October 2021, the company has updated its risk profile with one new risk factor under the Finance and Corporate category.

Danaher tells investors that it has designated a specific court in Delaware as the exclusive forum for resolving lawsuits against it. It warns that it may incur additional litigation expenses if forced to settle lawsuits outside its preferred court. The company goes on to state that settling disputes outside its preferred court may result in unfavorable outcomes, which could, in turn, adversely affect its business and finances.

The majority of Danaher’s risk factors fall under the Legal and Regulatory category, with 23% of the total risks. That is below the sector average of 27%. Danaher’s stock price has gained about 41% year-to-date.

Analysts’ Take

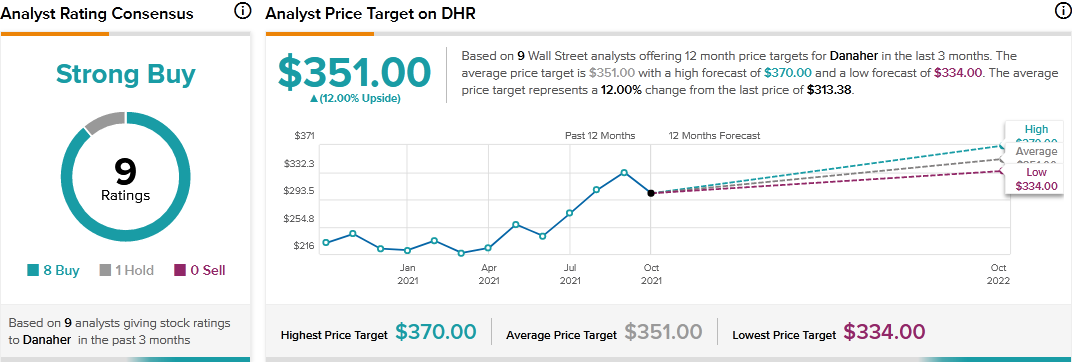

Cowen & Co. analyst Dan Brennan recently reiterated a Buy rating on Danaher stock and raised the price target to $360 from $350. Brennan’s new price target suggests 14.88% upside potential.

Consensus among analysts is a Strong Buy based on 8 Buys and 1 Hold. The average Danaher price target of $351 implies 12% upside potential to current levels.

Related News:

Understanding Apyx Medical’s Newly Added Risk Factor

What Do Electric Last Mile Solutions’ Newly Added Risk Factors Reveal?

Qualtrics International Beats Q3 Expectations and Raises FY2021 Outlook