Geron Corporation (GERN) is an American biopharmaceutical company. Its imetelstat drug candidate is in Phase 3 clinical trials and has been granted Fast Track designation by the FDA. Geron plans to apply for marketing approval for the drug candidate in the U.S. in 2023 and also plans to seek marketing authorization in Europe.

Let’s take a look at Geron’s latest financial performance, corporate updates, and changes in risk factors. (See Geron Corp stock charts on TipRanks).

Q2 Financial Results

Geron reported revenue of $107,000 for Q2 2021, compared to $43,000 in the same quarter last year. The company’s main sources of revenue currently are license fees and royalties.

Geron posted a loss per share of $0.09. That compared to a loss per share of $0.06 in the same quarter last year and missed the consensus estimate of a loss per share of $0.08.

Corporate Updates

Geron ended Q2 with $239.1 million in cash and marketable securities. With its available cash, combined with the financing available under its current debt facility, Geron expects to have sufficient financial resources to be able to fund its operations until the end of Q1 2023.

The company expects to complete enrollment for the IMerge Phase 3 trial of imetelstat in Q4 2021 and hopes to have top-line results by Q1 2023.

Risk Factors

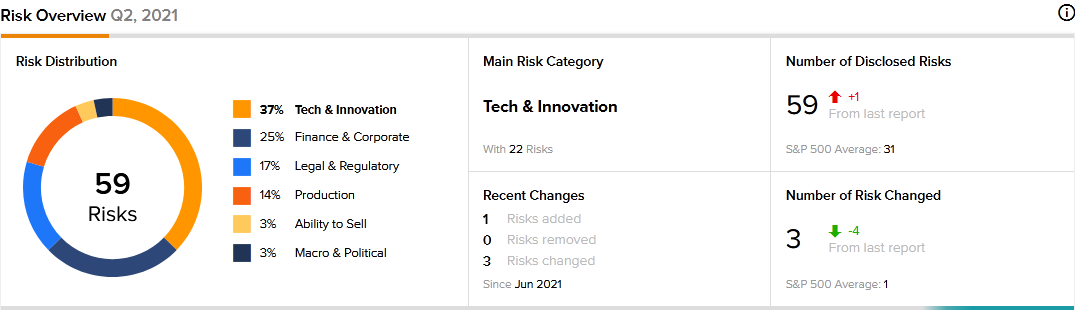

The new TipRanks Risk Factors tool reveals 59 risk factors for Geron. Since Q4 2020, the company has updated its risk profile with one new risk factor under the Tech and Innovation category.

Geron tells investors that the way a clinical trial is designed can determine whether its outcome will support the regulatory approval of a product candidate. It goes on to say that trial design flaws may go undetected until the trial has been completed. Therefore, Geron cautions that trial design issues could delay or prevent the marketing approval of its imetelstat product candidate. The company revealed that it decided not to follow a certain FDA recommendation regarding the imetelstat trial design.

The majority of Geron’s risk factors fall under the Tech and Innovation category, with 37% of the total risks. That is above the sector average of 26%. Geron’s stock has declined about 16% year-to-date.

Analysts’ Take

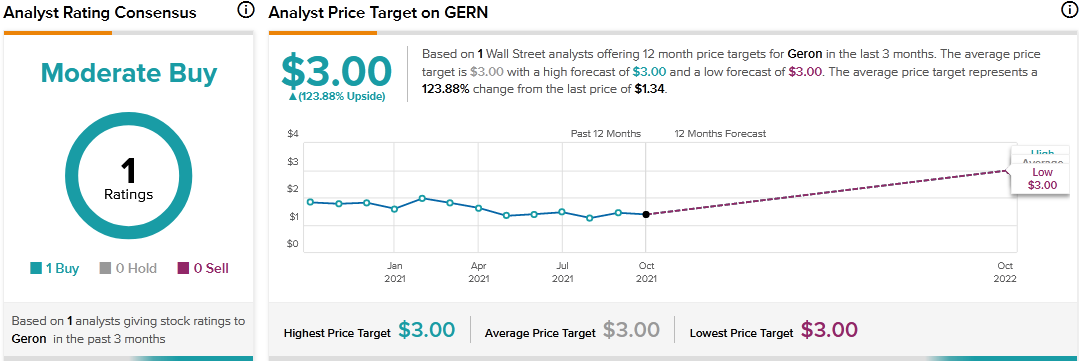

In August, Needham analyst Chad Messer assigned Geron stock a Buy rating with a price target of $3. Messer is the only analyst to have assigned a stock rating to GERN in the last 3 months, and his price target suggests 123.88% upside potential from current levels.

Related News:

General Motors Partners with Wolfspeed on Electric Vehicle Programs

Cousins Properties Acquires Office Building in Tampa

ContextLogic Partners with Spain-Based Correos