California-based Bill.com Holdings (BILL) provides finance software for small businesses. It works with third parties such as banks, accounting firms, and accounting software vendors to serve its customers.

For its Fiscal Q2 2022 ended December 31, Bill.com reported a 190% year-over-year increase in revenue to $156.5 million. It posted a loss per share of $0.78, compared to a $0.21 loss per share in the same quarter the previous year.

For Q3 ending March 2022, Bill.com anticipates revenue in the band of $157 million to $158 million and an adjusted loss per share in the range of $0.16 to $0.15.

Bill.com has recently acquired two businesses, Divvy and Invoice2go, to enhance its solutions for small businesses. It paid for the acquisitions with cash and stock.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Bill.com.

Risk Factors

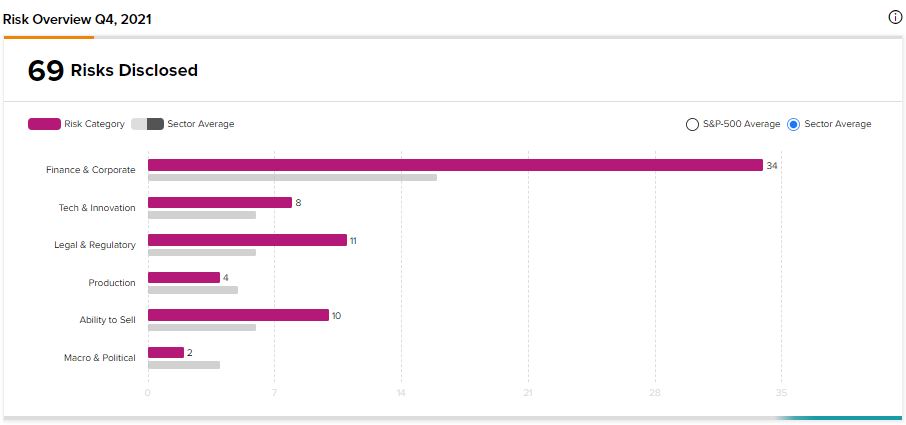

According to the new TipRanks Risk Factors tool, Bill.com’s main risk category is Finance and Corporate, which contains 34 of the total 69 risks identified for the stock. Legal and Regulatory and Ability to Sell are the next two major risk categories, with 11 and 10 risks, respectively. Bill.com has recently added two new risk factors and updated several previously highlighted risks.

The company tells investors that it relies on partners like banks to service its business operations. It mentions processing payments, cross-border fund transfers, and check printing. Therefore, the company cautions that its business may be adversely affected if it fails to effectively manage its relationships with its third-party providers.

Bill.com informs investors in an updated risk factor that it ended 2021 with $1.15 billion in outstanding debt on its 2025 notes and $575 million outstanding on its 2027 notes. It explains that its ability to service the debts depends on the performance of its business, which is subject to many factors beyond its control, such as economic and competitive conditions.

As a result, Bill.com cautions that its business may not generate sufficient cash flow to meet its debt obligations and allow it to make the necessary capital investments. Additionally, the company warns that defaulting on the debt obligations could cause its credit rating to be downgraded, which could, in turn, make it even more difficult to obtain additional financing in the future.

Regarding the acquisitions of Divvy and Invoice2go, Bill.com reminds investors in an updated risk factor of the various challenges it may face. The company cautions that it may not achieve the anticipated benefits of the Invoice2go acquisition. It mentions that it may need to invest significant resources and time into the business to meet various requirements. Concerning Divvy, Bill.com warns that businesses that use Divvy’s credit card may fail to repay their balances as required. As a result, Bill.com may incur financial losses, and its relationships with its funding partners may also be strained.

Bill.com’s stock has gained more than 72% over the past 12 months.

Analysts’ Take

KeyBanc analyst Josh Beck recently reiterated a Buy rating on Bill.com stock and raised the price target to $250 from $225. Beck’s new price target suggests 8.79% upside potential.

Consensus among analysts is a Strong Buy based on 9 Buys and 1 Hold. The average Bill.com Holdings price target of $279.40 implies 21.59% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Take-Two Posts Mixed Q3 Results; Shares Sink More Than 2%

Tyson Foods Delivers Outstanding Q1 Results; Shares Hit All Time High

Bumble Acquires French Dating App Fruitz