Associated Banc-Corp (ASB) is a bank holding company based in Wisconsin. It operates more than 220 banking locations through which it serves retail and commercial customers.

Let’s take a look at the company’s latest financial performance and understand what has changed in its risk factors. (See Associated Banc-Corp stock charts on TipRanks).

Q2 Financial Results

The company reported net interest income of $180 million for the second quarter of 2021. It posted earnings of $0.56 pershare, compared to $0.26 per share a year ago. The Street had expected the company to post earnings of $0.48 per share.

The company said it continued to see improvements in its credit business and remained optimistic of the unfolding recovery. It expects the commercial loan portfolio to grow between 2% and 4% in 2021.

Risk Factors

According to the new TipRanks’ Risk Factors tool, ASB’s main risk category is Finance & Corporate, which acccounts for 47% of the total 70 risks identified. Since Q4 2020, the company has updated its risk profile with three new risks.

Associated Banc-Corp tells investors that cyberattacks have increased and become more sophisticated. It mentions that the shift to remote work because of the COVID-19 pandemic has increased cybersecurity vulnerability. The company cautions that if it becomes a victim of a successful cyberattack, it may suffer reputation damage, face regulatory fines and undertake expensive corrective measures, which could adversely impact its financial condition.

The company further cautions investors that it may face negative media coverage with respect to environmental, social and governance (ESG) matters. It says that negative publicity could adversely impact its ability to attract and retain customers. The company warns that its stock price may be adversely impacted if investors determine that the company has not made enough progress on ESG matters.

Associated Banc-Corp tells investors that the Biden administration is seeking to increase competition in the financial services sector. It says that the President has issued directives that could make completing acquisitions difficult in the future. The company further says that a rule on the portability of consumer financial data could increase volatility in its consumer accounts and expose it to more compliance challenges.

The Finance & Corporate risk factor’s sector average is at 58.6%, compared to ASB’s 47%. Shares of the company have gained about 28% year-to-date.

Analysts’ Take

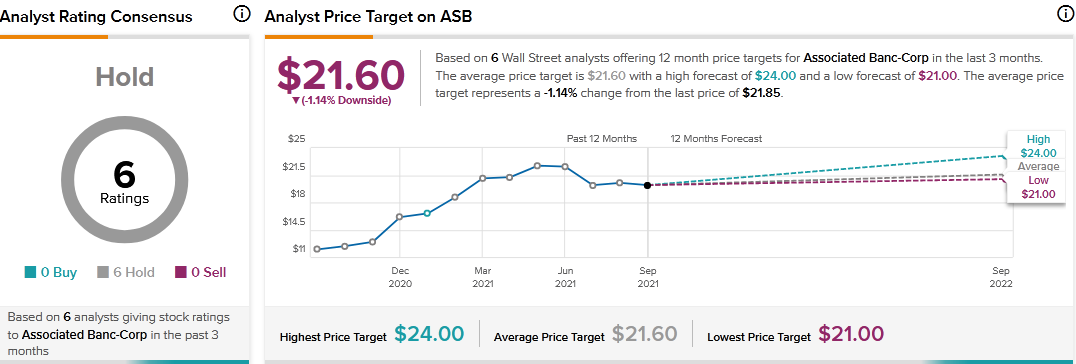

Two months ago, Piper Sandler analyst Nathan Race reiterated a Hold rating on Associated Banc-Corp stock but lowered the price target to $21 from $23. Race’s new price target suggests 3.89% downside potential.

Consensus among analysts is a Hold based on 6 Holds. The average Associated Banc-Corp price target of $21.60 implies 1.14% downside potential from current levels.

Related News:

Hyatt Prices $1.75B Senior Notes Offering

Asensus Surgical’s Senhance Robotic System Purchased by Loginov Moscow Clinical Scientific Center

Amazon to Offer Business Insurance in U.K. — Report