Last week, the world witnessed the use of hypersonic weaponry for the first time in the Russia-Ukraine conflict. Since the beginning of the Russian invasion of Ukraine in February, global markets for capital, energy, and commodities, have been on a rollercoaster with diverse trends.

However, defense contractors from the U.S. have been the talk of the town, and rightly so.

Add to this, Chinese sanctions on U.S. defense contractors such as Lockheed Martin and Raytheon Technologies over Taiwan will keep investors interest levels piqued in these stocks.

Let us take a deeper look at three major U.S. defense contractors, Lockheed Martin (LMT), Raytheon Technologies (RTX), and Northrop Grumman (NOC), and see how they have fared so far and what the tea leaves may reveal about them to the savvy investor.

Lockheed Martin

The world’s™ biggest defense contractor has expertise in defense, space, homeland security, and IT and cyber security. The stock has already climbed 24.2% so far this year.

In 2021, LMT racked up $67 billion in revenue, while order backlog stood at $135 billion pointing towards revenue visibility. Forward yield is pegged at 2.5%

Meanwhile, across the pond, Germany has announced the creation of a $113 billion special fund to remilitarize its armed forces and will raise its defense spending above 2% of its GDP. Concurrently, the country is replacing its Tornado bomber jets with U.S.-made F-35A crafts.

Germany’s Air Force Commander, Ingo Gerhartz, stated, “There can be only one answer to Putin’s aggression, Unity in NATO and a credible deterrent. This in particular means there is no alternative but to choose the F-35.”

While Lockheed’s earnings before interest, taxes, depreciation and amortization (EBITDA) margin at 13.4% compares favorably with the industry median of 13.3%, the company is far ahead of its peers on other metrics. Return on total capital at 23.1% is 4x better than the industry median of 6.8%. Net income per employee of $55,400 is over two times better than the industry median of $20,500, indicating that Lockheed is far ahead of the curve when it comes to utilizing its workforce.

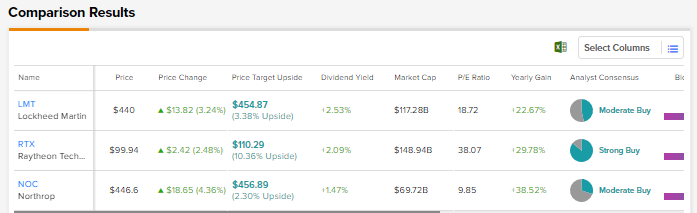

Vertical Research analyst Robert Stallard has reiterated a Buy rating on the stock alongside a price target of $483. Overall, the Street has a Moderate Buy Consensus rating on the stock based on 7 Buys and 8 Holds. The average Lockheed Martin price target of $454.87 implies a potential upside of 4.43% for the stock, at the time of writing.

Raytheon Technologies

The war in Ukraine has put the spotlight on Javelin and Stinger missiles, which Raytheon provides. These weapons have been critical in the Ukrainian pitched defense seen so far. Raytheon also provides aircraft engines, guided missiles, avionics systems, as well as communications and surveillance satellites. The stock has gained 14.9% so far this year.

The company is also planning to shift production of its Patriot missile parts to Saudi Arabia, one of the major buyers of U.S.-made defense equipment. Raytheon raked in $64.4 billion in revenue for 2021. It also repurchased shares worth $2.3 billion, pointing towards incremental improvements in earnings multiples.

Further, the company has a healthy order backlog of $156 billion, of which $93 billion was for commercial aerospace and the remaining $63 billion was for defense. Of these bookings, $729 million was for two standard Missile-2 (SM-2) production contracts for the U.S. Navy and international customers; $269 million was for Evolved Seasparrow Missile (ESSM) for the U.S. Navy and international customers; and about $847 was for F-135 sustainment and production contracts. RTX stock has a forward yield of 2%.

While Raytheon’s EBITDA margin at 17.7% compares favorably with the industry median of 13.3%, the company’s return on total capital at 3.9% is behind the industry median of 6.8%. Although net income per employee of $22,200 is better than the industry median of $20,500, it significantly lags the efficiency of Lockheed.

Wolfe Research analyst Michael Maugeri has reiterated a Buy rating on the stock, but has decreased the price target to $111 from $112. The Street has a Strong Buy consensus rating on the stock based on six Buys and one Hold. The average Raytheon price target of $110.3 implies potential upside of 10.96% for the stock, at the time of writing.

Northrop Grumman

We round off our list with Northrop Grumman, one of the largest players in the defense and aerospace industry, with expertise in aeronautics, defense systems, mission systems, and space systems. Notably, the company provides a number of key components for the F-35 fighter jets. The stock is up 14.3% over the past month and about 42.1% over the past year.

In 2021, Northrop generated $35.7 billion in revenue and returned $4.74 billion to investors via stock buybacks and dividends. Additionally, it upped its dividend by 8%, which was also its 18th consecutive yearly increase. Its forward yield is estimated at 1.4%. In the future, Northrop’s heavy bomber is expected to generate significant revenue for the company.

Northrop’s EBITDA margin at 24.5% is ahead of the industry median of 13.3%, and beats both Lockheed and Raytheon. The company’s return on total capital at 17.1% is almost 3x the industry median of 6.8%, and is second to Lockheed on our list. Net income per employee of $79,600 is also better than the industry median of $20,500, and outperforms both Lockheed and Raytheon, indicating Northrop is far superior in utilizing its human capital.

Vertical Research analyst Robert Stallard has reiterated a Hold rating on the stock, while raising the price target to $435 from $400. Overall, the Street has a Moderate Buy consensus rating on the stock based on 3 Buys and 7 Holds. The average Northrop price target of $456.89 implies a potential upside of 3.78% for the stock, at the time of writing.

Closing Note

In a period of broader turmoil and global uncertainty, these three defense names offer not only safety for retail investors but also possible gains on their investments.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Membership Collective to Buyback Shares Worth $50 Million

Capital One and Kohl’s Extend Credit Card Partnership

Walmart, Inc. Updates 1 Key Risk Factor