UiPath, Inc. (PATH) a dominant player in robotic process automation (RPA) and artificial intelligence (AI), is scheduled to release its first-ever quarterly results post-IPO. Shares of the company have gained 9.8% since it commenced trading on April 21.

UiPath is an enterprise automation software vendor that helps organizations efficiently automate business processes. In simple terms, the company automates repetitive business processes, which saves time and money, helping employees focus on more meaningful, strategic work.

As of January 31, 2021, the company had 7,968 customers, representing an increase of 33% year-over-year. Its customers include 80% of the Fortune 10 companies and 63% of the Fortune Global 500 companies. (See UiPath stock analysis on TipRanks)

Prior Period Results

For the fourth quarter of 2021, the company reported revenue of $207.88 million, up 81% year-over-year, including Licenses revenue of $124.21 million, Maintenance and Support revenue of $75.91 million, and Services and Other revenue of $7.76 million.

Net income for the quarter came in at $26.26 million, compared to a loss of $78.09 million in the year-ago period.

For the full fiscal year 2021, the company reported revenue of $607.64 million, an increase of 80.8% from the year-ago period. Compared to the prior year, Licenses revenue grew 72% to $346.04 million, Maintenance and Support revenue grew 94% to $232.54 million, and Services and Other revenue grew 95% to $29.07 million.

The company reported an annual net loss of $92.39 million compared to a loss of $519.93 million in full FY2020.

At the quarter-end, the company’s Annualized Renewal Run-Rate (ARR) was $580.48 million, up 65% year-over-year, and the net retention rate was 145%, demonstrating the stickiness of the company’s products category and the platform in particular.

Customers contributing more than $100,000 to ARR grew 68% to 1,002 customers, and those contributing more than $1 million to ARR, more than doubled to 89 customers.

Factors to Watch Out For

UiPath is disrupting a large and fast-growing Intelligent Process Automation (IPA) market. According to a study by IDC, that market is expected to grow at a CAGR of 16% to $30 billion by the end of 2024. However, the company projects the current global market opportunity to be more than $60 billion.

For Q1, the company is expected to report strong top-line numbers supported by continued momentum in ARR and retention rates. Also, secular tailwinds will support the company’s performance going forward. Tailwinds include the increasing need of companies for speed and agility and a rise in citizen developers.

Additionally, as of January 2021, the company has $414.04 million of Remaining Performance Obligations (RPO). Of that, it expects to recognize around 65% as revenue in FY22, translating to sound revenue in the first quarter.

Analysts Weigh In

Recently, Needham analyst Scott Berg initiated coverage on PATH with a Buy rating and a price target of $85, implying 12.2% upside potential to current levels.

Anticipating strong Q1 results, Berg said, “We expect UiPath to report 1Q revenue/non-GAAP EPS above our estimates given initial conservatism.” He added, “We expect the company to provide initial total revenue growth guidance of at least 40% for the year with sequential beat and raises throughout the year, and a 50%+ total growth figure likely by year-end.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 12 Holds. UiPath average analyst price target of $75.50 implies that shares are almost fully valued at current levels.

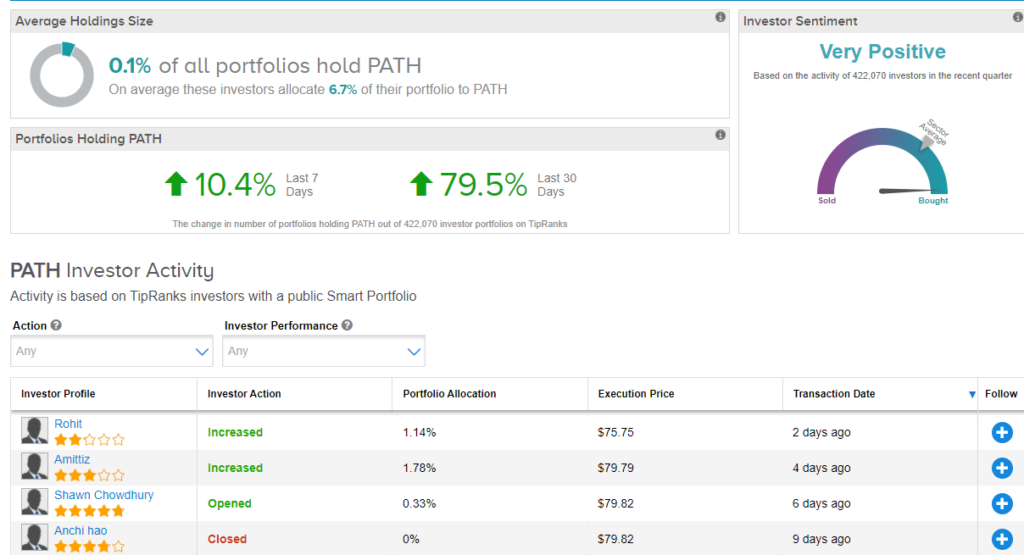

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on UiPath, with 79.5% of investors who hold portfolios on TipRanks increasing their exposure to PATH stock over the past 30 days.

Related News:

J.M. Smucker Tops Q4 Results; Shares Gain

CrowdStrike Posts 400% Earnings Growth in Q1, Raises FY22 Guidance

Five Below Delivers Blowout Q1 Earnings; Shares Pop 6% After-Hours