Swiss banking giant UBS Group AG (UBS) was found guilty in a long-standing French Tax case. On the brighter side, the court slashed the penalty to around $2 billion from the earlier penalty of around $5 billion.

Following the news, shares of UBS in the Swiss Stock Exchange spiked about 3% yesterday. Meanwhile, at the NYSE, shares are up almost 1% during pre-market trading at the time of writing.

French Tax Evasion Case

UBS has been fighting France’s biggest tax evasion case for years, which relates to cross-border business transactions with French residents between 2004-2012. The bank was allegedly helping wealthy French citizens to open bank accounts in Switzerland and transfer their funds, thereby avoiding French taxes.

In a verdict in 2019, the judges had slammed UBS with a massive fine of €3.7 billion ($4.2 billion) along with a €800 million fine towards damages and interest. The fine had put the banks’ financial position in jeopardy. UBS had created a provision of €450 million against the matter in 2018 and also reduced its bonus payments in 2019.

The appeals court heard the case in March 2021, wherein the prosecutors had demanded at least a €2 billion fine, while the French government had claimed damages of €1 billion. The reduced penalty reflects the fine calculated on tax not withheld rather than the total amount of client funds involved, which was contested by UBS in the 2019 case hearing.

In the final judgement passed yesterday, UBS was fined €3.75 million along with €800 million in civil damages to be paid to the French government. The court has also ordered the confiscation of €1 billion. Moreover, UBS France S.A. is fined €1.875 million.

The company said that it would consider all options and decide whether to appeal the verdict. Following which fines on both UBS AG and UBS France S.A. would be suspended.

Management Comments

Responding to the news, the company stated, “UBS AG was found guilty of unlawful solicitation and aggravated laundering of the proceeds of tax fraud relating to the bank’s cross-border business activities in France between 2004 and 2012.”

The company added, “UBS (France) SA was acquitted on charges of aiding and abetting of laundering the proceeds of tax fraud and was found guilty of aiding and abetting of unlawful solicitation.”

See Analysts’ Top Stocks on TipRanks >>

Analysts’ Take

Following the news, RBC Capital analyst Anke Reingen maintained a Buy rating on the stock with a price target of $23.84 (CHF22) which implies 34.2% upside potential to current levels.

Overall, the stock commands a Strong Buy consensus rating based on 8 Buys, 2 Holds, and 1 Sell. The average UBS Group AG price target of $21.48 implies 20.8% upside potential to current levels. Shares have gained 27.5% over the past year.

Smart Score

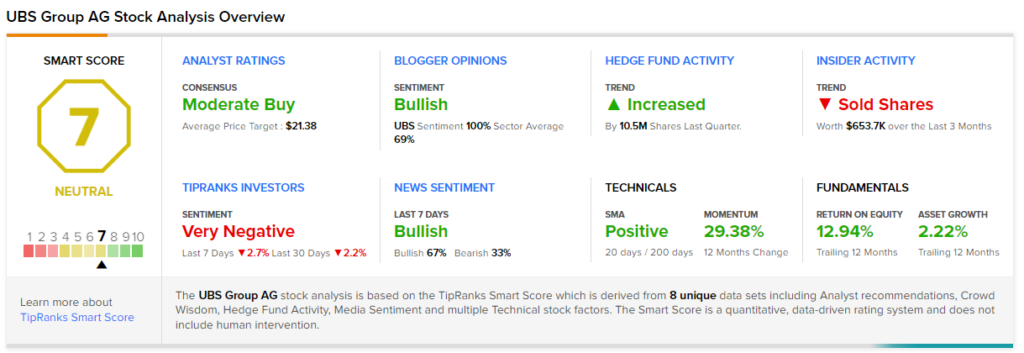

According to TipRanks’ Smart Score system, UBS score a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Meta Platforms Buys Name Rights for Meta

Bristol Myers Squibb Rewards Shareholders; Shares Up 4.8%

Abbott Rewards Shareholders; Shares Record New All-Time High