Uber Technologies, Inc.’s (UBER) food delivery app, Uber Eats announced its partnership with Australian supermarket chain Woolworths Group to satiate the growing demand for doorstep grocery deliveries. The companies will ensure same-hour grocery delivery through this partnership, a Reuters report said.

Shares of the ridesharing and food delivery service provider were down 5.5% in the pre-market trading session at the time of writing. The fall came after a California judge ruled against Proposition 22, filed in November 2020, wherein ride-hailing services like UBER wanted to keep their drivers’ status as independent contractors to avoid granting them employee-related benefits. (See Uber stock charts on TipRanks)

The COVID-19 pandemic and related restrictions have accelerated demand for home delivery services for both essential and non-essential products. In response to the heightened demand for doorstep delivery of groceries, UBER and Woolworths will together reduce the delivery time to the same hour by channeling each other’s core competencies.

The Uber Eats app will start hosting Woolworths locations beginning the last week of August and cater to account holders in Sydney and Melbourne first, followed by expansion along the eastern seaboard in the following weeks. Similarly, Uber Eats will be featured as a delivery option on the Woolworths website for customers shopping online.

Today, Wells Fargo analyst Brian Fitzgerald maintained a Buy rating on UBER with a price target of $78, implying a whopping 95.2% upside potential to current levels.

Based on the analysis of third-party data through the end of July, the analyst raised the company’s FY21, FY22, and FY23 Delivery segment gross bookings.

Fitzgerald said, “Our Overweight Rating is supported by the fact that Uber is a market leader in the Ridesharing and Meal Delivery industries globally. We think Uber’s strong capital position and variable cost structure will limit the risk of insolvency during an economic downcycle.”

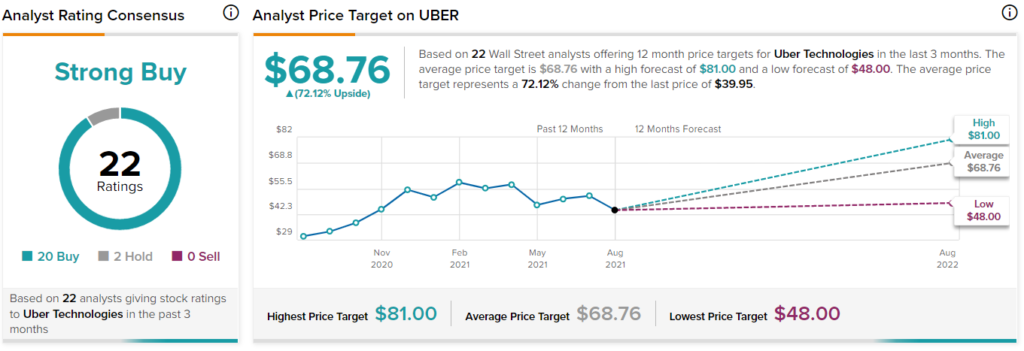

Overall, the stock has a Strong Buy consensus rating based on 20 Buys and 2 Holds. The average Uber price target of $68.76 implies 72.1% upside potential to current levels. Shares have gained 28.7% over the past year.

Related News:

DoorDash Ends Plan to Invest in Grocery Startup Gorillas

Nexstar Snaps up The Hill for $130M

BJ’s Wholesale Exceeds Q2 Expectations; Shares Pop 4%