103 economists polled by Reuters now expect a 35% median probability of a recession over the next 12 months, down from 45% in April. The odds declined after the U.S. and China agreed to temporarily slash tariffs on each other.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The same economists unanimously believe that President Trump’s policies have “hurt” the economy while over 55% believe that they have “significantly hurt” the economy.

Reuters Poll Calls for 3.1% Inflation in 2025

The poll also found that consumer price index (CPI) inflation is expected to be 3.1% in 2025, falling from the 3.2% estimate last month. For 2026, CPI is expected at 2.8%, down from 2.9% in April. Both estimates are still well above the Fed’s goal of 2% inflation.

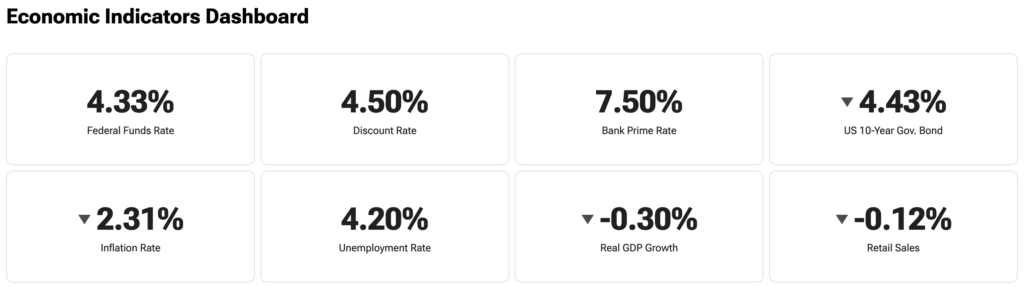

By the end of the year, 74 of the economists expect the minimum federal funds rate to be between 3.75% and 4.00% compared to the current rate of between 4.25% and 4.50%. The rate is highly dependent on inflation and is less likely to fall if inflation is elevated.

Stay up to date on the latest economic metrics with TipRank’s Economic Indicators Dashboard.