According to a report by StreetInsider.com, Advanced Micro Devices’ (AMD) takeover of Xilinx (XLNX) has been approved by the U.K.’s Competition and Markets Authority (CMA).

California-based Advanced Micro Devices is a semiconductor company that designs computer processors and related technologies. Xilinx is a semiconductor manufacturing firm that develops and produces programmable logic semiconductor devices and related software.

In October 2020, the companies announced that Advanced Micro Devices would acquire Xilinx in an all-stock transaction worth $35 billion. (See Xilinx stock chart on TipRanks)

The acquisition is yet to receive approval in China. Shares of Advanced Micro Devices closed 2.4% higher on Tuesday, while Xilinx’s shares ended the day 4.2% higher. (See Advanced Micro Devices stock chart on TipRanks)

Piper Sandler analyst Harsh Kumar recently maintained a Buy rating on Advanced Micro Devices with a price target of $110 (23% upside potential).

In a research note to investors, Kumar said, “While the stock has underperformed the semiconductor index by 18% year-to-date, we do not feel the party is even close to being over and are buyers at current levels.”

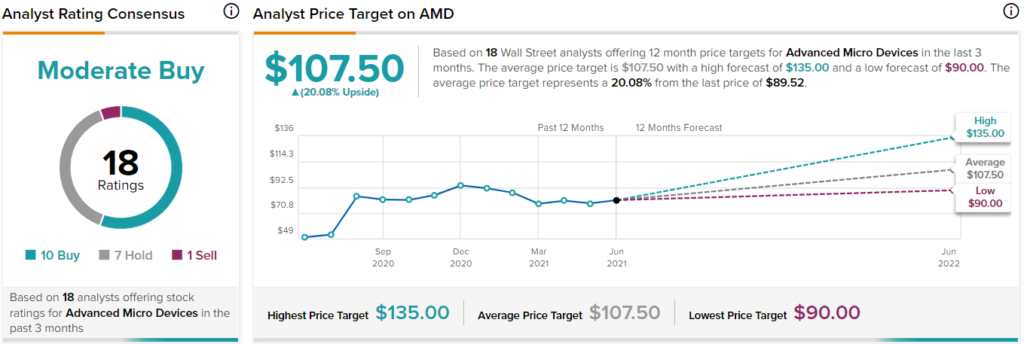

Overall, Advanced Micro Devices has a Moderate Buy consensus rating based on 10 Buys, 7 Holds, and 1 Sell. The average Advanced Micro Devices price target of $107.50 implies 20% upside potential from current levels. The company’s shares have gained 70.2% over the past year.

Related News:

Repay Joins Hands with Premier to Provide Accounts Payable Solutions to Healthcare Providers

Walmart Launches Its Own Insulin Brand

Valley National Bancorp Snaps Up The Westchester Bank