Shares of Tyson Foods (NYSE: TSN) fell over 5% in pre-market trading after the company which processes chicken, beef, and pork reported a miss on both the top line and bottom line. The company reported adjusted earnings for its first quarter of FY23 of $0.85 per share versus $2.87 in the same period a year back and missing consensus estimates of $1.31. Sales increased by 2.5% year-over-year, with revenue hitting $13.3 billion and missing analysts’ expectations by $250 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Donnie King, President and CEO of Tyson Foods outlined the reasons for the dismal fiscal Q1 performance stating, “We faced some challenges in the first quarter. Market dynamics and some operational inefficiencies impacted our profitability.”

Looking forward, management now expects revenues in the range of $55 billion to $57 billion in FY23. Moreover, the company achieved more than $700 million of productivity savings in FY22 and believes that it will exceed its target of $1 billion this year.

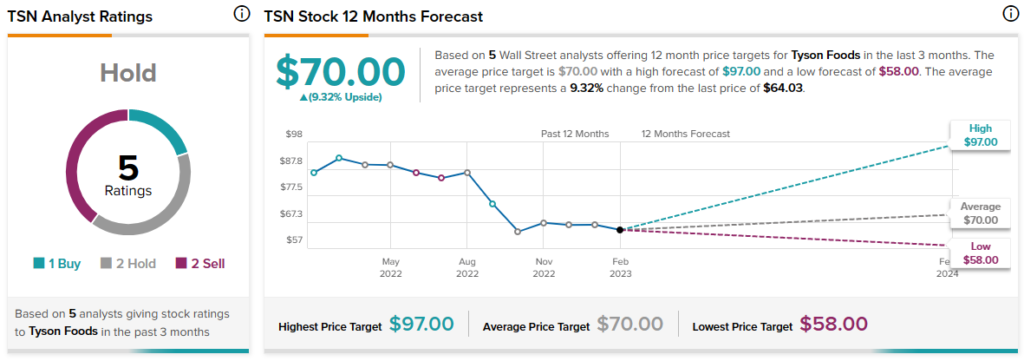

Analysts are sidelined about TSN stock with a Hold consensus rating based on one Buy, two Holds, and two Sells.