Social media giants Facebook and Twitter sparked debates after they banned Donald Trump on their platforms following the US Capitol attack. These two platforms boast a massive user base and have seen increased social engagement since the pandemic and amid recent political turmoil.

Investors are keen to know how such bans will impact these social media companies. Meanwhile, with the rollout of vaccines, there are expectations that social media companies will benefit from higher ad spending amid improved business conditions. We will discuss what Wall Street analysts think about Facebook and Twitter and use the TipRanks Stock Comparison tool to pick the stock offering a more compelling investment opportunity.

Twitter (TWTR)

Shares of micro-blogging site Twitter fell when the company announced a ban on Trump, one of the most followed users on its platform.

Rosenblatt Securities analyst Mark Zgutowicz believes that the ban could pose significant hurdles to the company’s 2021 mDAUs (monetizable daily active users) and ad revenue “on top of already tough COVID user compares,” which he estimates added about 3 million and 15 million incremental US and outside US mDAUs (estimated), respectively, last year.

Zgutowicz further stated that his scenario analyses indicated that the ban could wipe off 6 million-9 million US mDAUs this year. The analyst argued that the move, along with tough COVID-induced user growth comparables, leave the company a “little room to deliver positive ’21 results.” The analyst reiterated a Hold rating on Twitter and lowered his price target slightly to $39 from $40.

Meanwhile, Twitter is scheduled to announce its 4Q and full-year results on February 9. The company exceeded analysts’ revenue and earnings expectations for 3Q but the growth in mDAUs fell short of expectations. (See TWTR stock analysis on TipRanks)

The company’s 3Q advertising revenue increased about 15% to $808 million as ad engagements increased 27% but the cost per engagement declined 9%. Overall revenue rose 14% to $936 million in the quarter. Average mDAU came in at 187 million (up 29% year-over-year), while analysts were calling for a 3Q mDAU of 195 million.

Speaking about 4Q, Twitter highlighted tailwinds like product launches, return of events and the holiday shopping season. However, the company also cautioned about uncertainty related to advertiser behavior around the elections in the quarter.

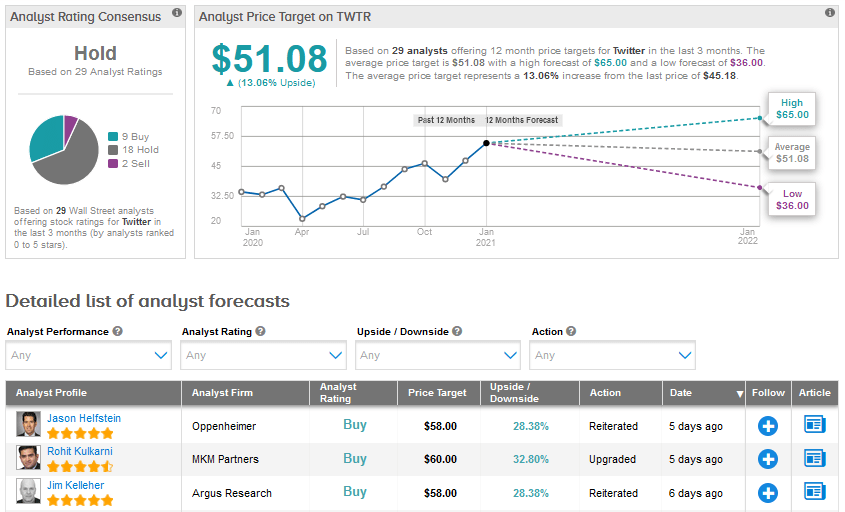

Currently, the Street is sidelined on the stock with 9 Buys, 18 Holds and 2 Sells adding up to a Hold analyst consensus. Shares have already risen 32% over the past year and the average price target of $51.08 indicates an upside potential of 13.1% from current levels.

Facebook (FB)

Facebook has been in hot water due to antitrust litigations by the Federal Trade Commission and several states. The company is being accused of using its dominant position to crush small rivals. As per the leading social media platform, 2.5 billion people around the world use one or more of its apps (Facebook, Instagram, Messenger, WhatsApp) every day. It also claims that it has over 10 million active advertisers across its services.

The company’s advertising revenue grew 22% year-over-year to $21.2 billion in 3Q, with overall revenue up 22% to $21.5 billion. On its 3Q earnings call, the company stated it expects its 4Q ad revenue growth rate to be higher, backed by strong advertiser demand in the holiday season.

That said, talking about 2021, the company cautioned investors about the impact on ad revenue of a possible slowdown in e-commerce trends following the acceleration seen last year, a change to Apple’s ad tracking technology in iOS 14 and regulatory pressures.

Meanwhile, Facebook is gradually seeking opportunities to grow its revenue beyond advertising. The company is positive about the demand for its Oculus Quest 2 virtual reality headset. It also sells Portal, a video communication device with Alexa built into it. What’s more, it has partnered with Ray-Ban maker Luxottica to build its first smart glasses. (See FB stock analysis on TipRanks)

Facebook shares took a hit recently when the news of WhatsApp’s updated data policy triggered concerns and led to a rise in downloads for rival messaging apps Signal and Telegram. Merrill Lynch analyst Justin Post believes that the impact on Facebook shares due to privacy worries about WhatsApp’s data policy and rising competition will be short lived.

Post argued, “In addition to WhatsApp’s large and sticky application, per Business Insider, the executive chairman of Signal (Brian Acton) said he has no desire to do all the things that WhatsApp does, and expected people to rely on Signal to talk to family and close friends. In our view, given privacy policies that prevent WhatsApp from reading personal messages, and the large established user base that creates stickiness, we think the controversy on WhatsApp will fade, and the app will maintain high engagement for the vast majority of core users.”

The 5-star analyst also pointed out that the Facebook/Cambridge Analytica data scandal seemed much worse but still the long-term impact was limited. Post concluded that with over 2 billion users and still very limited revenues, he continues to see WhatsApp as a key driver of potential future value in Facebook.

In line with his optimistic view, Post reiterated a Buy rating with a price target of $345 (upside potential 37.3%).

All in all, Facebook scores a Strong Buy analyst consensus based on 31 Buys, 2 Holds and 1 Sell. The average price target stands at $324.84, reflecting an upside potential of about 29.2% in the 12 months ahead. Shares have risen about 13.2% over the past year.

Conclusion

Facebook’s large user base and dominant position give it an edge over Twitter when it comes to gaining advertisers’ attention. Currently, sentiment on the Street and higher upside potential make Facebook stock a better pick than its smaller rival Twitter.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment