Twitter, Inc. (NYSE: TWTR) has signed accelerated share repurchase agreements (ASRs) with Wells Fargo Bank and Morgan Stanley (NYSE: MS) to buy back common shares worth $2 billion.

Initially, Twitter will take delivery of around 37.8 million common shares, with the remaining shares likely to be delivered by the end of its third quarter of Fiscal Year 2022.

Ned Segal, Twitter’s CFO, said, “This significant buyback is an important demonstration of our conviction in our strategy and our commitment to delivering shareholder value through disciplined capital allocation.”

“Buying $2 billion of our shares in the near term, with the flexibility to buy another $2 billion over time, enables us to balance our long-term strategy with returning capital to shareholders,” Segal added.

About Twitter

California-based Twitter is a microblogging and social networking service company that connects a user to a network of people, ideas, news, opinions and information.

TWTR stock closed 3.3% down on Friday. It lost another 0.2% in after-hours trading to end the day at $35.78.

Wall Street’s Take

Last week, Wedbush analyst Ygal Arounian maintained a Hold rating on the stock and lowered the price target to $42 from $46 (17.2% upside potential).

Arounian believes Twitter is correctly valued as the company “continues to make progress on its initiatives.”

Additionally, Shyam Patil of Susquehanna reiterated a Buy rating on Twitter and reduced the price target from $85 to $50 (39.5% upside potential).

Patil said, “TWTR continues to benefit from the strength and recovery of brand budgets along with incremental improvements in DR. Given the nature of TWTR’s more brand-heavy advertising business, iOS 14 changes as well as supply chain challenges haven’t impacted TWTR as much as other more DR-heavy social platforms.”

“This advantage is helping to drive the solid 2022 outlook of low to mid 20s revenue growth ex-MoPub. Moreover, TWTR also expects accelerating mDAU growth throughout the year and maintained its 2023 mDAU target,” the analyst added.

Overall, the stock has a Hold consensus rating based on 8 Buys, 16 Holds and 2 Sells. The average TWTR price target of $47.12 implies 31.5% upside potential. Shares have lost 47.4% over the past six months.

Website Traffic

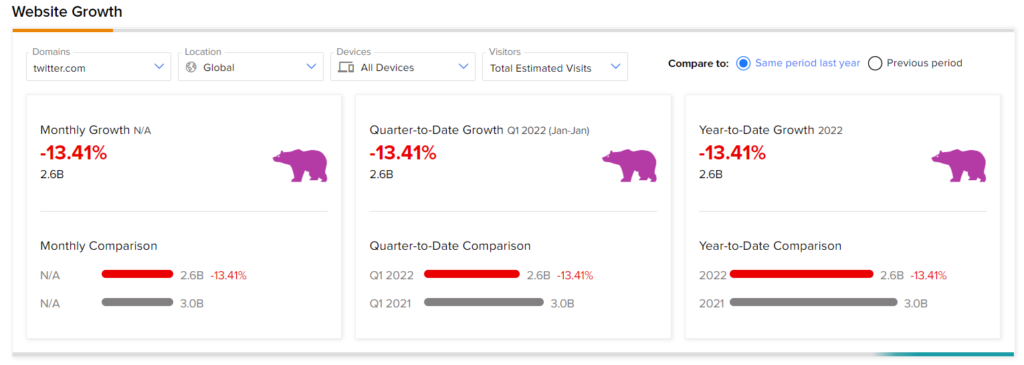

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Twitter’s performance.

According to the tool, compared to the previous year, Twitter’s website traffic has registered a 13.4% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

CAE Q3 Profit Falls 46%

Tapestry Outperforms Q2 Expectations Backed by Strong Holiday Season

Kinder Morgan Updates 1 Key Risk Factor