Twitter (TWTR) delivered fourth-quarter results that fell short of Wall Street expectations. Revenue and earnings missed estimates as total advertising engagement decreased 12% year-over-year. TWTR shares fell 1.98% to close at $37.08 on February 10.

Twitter is a social networking company that offers a platform to connect users to a network of friends, ideas, news, and other information. Twitter’s upcoming earnings report for Q1 2022 is scheduled for April 28, 2022.

Twitter Earnings

Fourth-quarter revenue was up 22% year-over-year to $1.57 billion but fell short of consensus estimates of $1.58 billion. The year-over-year increase was fuelled by advertising revenue increasing 22% to $1.41 billion. Full-year revenue increased 37% year-over-year to $5.08 billion.

Net income in the quarter landed at $182 million, down from $222 million delivered the same quarter last year. Diluted earnings per share came in at $0.33, below consensus estimates of $0.35 per share.

Average monthly daily active users (mDAU) increased to 217 million in the quarter compared to 192 million in the same period last year. In the U.S., mDAU averaged 38 million, an improvement from 37 million for the same period the previous year.

Outlook

Twitter is projecting revenue of between $1.17 billion and $1.27 billion for the first quarter of 2022. GAAP operating loss is expected at between $225 million and $175 million. It also projects capital expenditures of between $900 million and $950 million for the full year with stock-based compensation expenses of between $900 million and $925 million.

In addition, the Twitter board of directors has approved a new $4 billion share repurchase program to replace the previously approved $2 billion program from 2020.

Stock Rating

Yesterday Piper Sandler analyst Thomas Champion reiterated a Hold rating on the Twitter stock and cut the price target to $46 from $54, implying 24.06% upside potential to current levels.

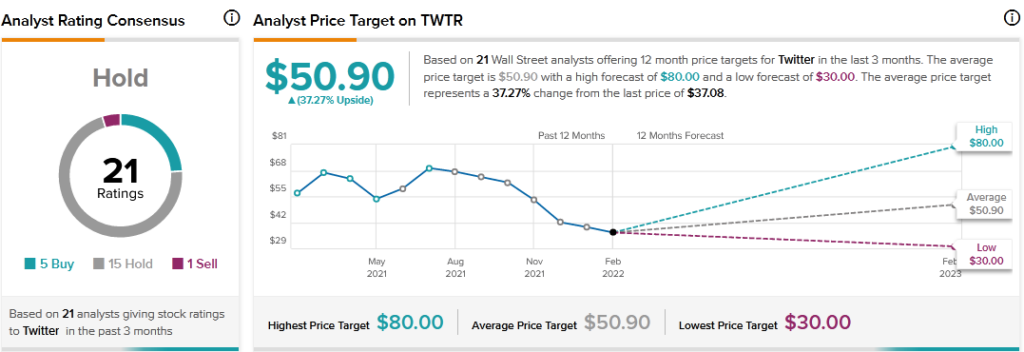

Consensus among analysts is a Hold based on 5 Buys, 15 Holds, and 1 Sell. The average Twitter price target of $50.90 implies 37.27% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Telus Q4 Profit More Than Doubles

Canada Goose Cuts FY 2022 Forecast; Shares Dip

Saputo Q3 Revenue Rises, Profit Falls