Cloud communications platform Twilio (NYSE: TWLO) recently reported stronger-than-expected results for the fourth quarter ended December 31, 2021. Robust revenue growth was the primary driver of the overall solid results of the company.

Following the upbeat earnings, shares of the company popped 18.2% to close at $238.80 in Wednesday’s extended trading session.

Revenue & Earnings

Twilio reported quarterly revenues of $842.7 million, up 54% from the same quarter last year. Further, the figure topped the consensus estimate of $767.83 million. Organic revenue grew 34% year-over-year and was the primary contributing factor to the overall growth in revenues.

The company reported a quarterly loss of $0.20 per share compared to earnings of $0.04 per share a year ago. The figure, however, came in narrower than the consensus estimate of a loss of $0.22 per share.

Other Operating Metrics

Twilio’s active customer accounts at the end of the quarter stood at 256,000, up from 221,000 in the previous year.

Further, the company’s Dollar-Based Net Expansion Rate at the end of the quarter was at 126% compared to 139% a year ago.

Outlook

For the first quarter of 2022, the company forecasts to incur a loss per share between $0.26 and $0.22 compared to the consensus estimate of a loss per share of $0.05.

Similarly, the company expects its revenue in the first quarter to be in the range of $855 million to 865 million against the consensus estimate of $802.9 million.

CEO’s Comments

The CEO of Twilio, Jeff Lawson, said, “Our fourth quarter capped off an amazing year of results as we delivered more than $2.8 billion in revenue for the year, growing 61% year-over-year. The combination of our leading cloud communications platform with Twilio Segment’s #1 customer data platform gives Twilio an unparalleled view into the customer journey, and I’ve never been more excited about the future of the company than I am today.”

Stock Rating

Prior to the earnings, JPMorgan analyst Mark Murphy reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $420 to $270, which implies upside potential of 33.6% from current levels.

Consensus among analysts is a Strong Buy based on 18 Buys and 1 Hold. The average Twilio stock prediction of $328.12 implies upside potential of 62.4% from current levels. Shares have declined 53.4% over the past year.

Website Traffic

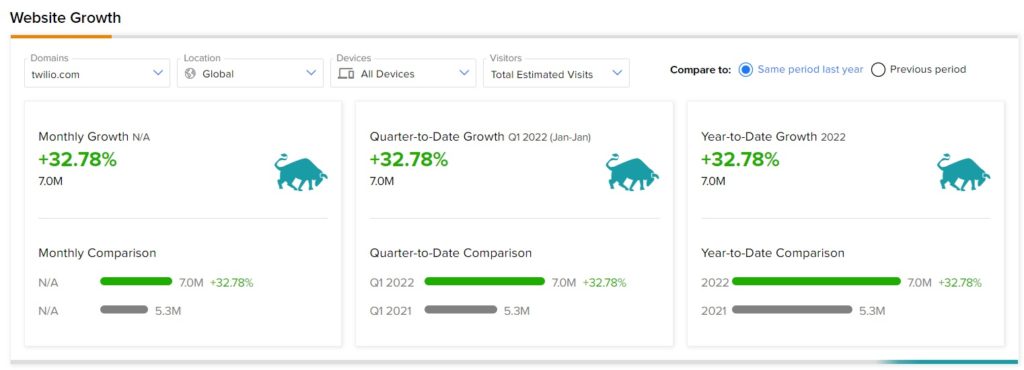

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Twilio’s performance this quarter.

According to the tool, year-to-date, the Twilio website traffic has recorded a rise of 32.78%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

CVS Reports Strong Q4 Results; Shares Fall 2.6% Pre-Market

Cognizant Renews Contract with Volvo Cars

Doximity Jumps Over 8% on Upbeat Q3 Results