The Trade Desk (TTD) recently reported earnings for its second quarter of Fiscal Year 2022. Adjusted earnings per share for TTD came in at $0.2, which met analysts’ consensus estimate of $0.2. In the past nine quarters, the company has met or beat estimates each time. In addition, sales increased 35% year-over-year, with revenue hitting $377 million compared to $280 million. As a result, shares rallied over 17% in after-hours trading.

The company has managed to demonstrate strong customer retention once again. Indeed, it has retained more than 95% of its customers for eight consecutive years.

However, operating income decreased from $61.9 million to $1.7 million, which means that the company did not demonstrate any operating leverage. This decline can be attributed to significantly higher stock-based compensation (SBC) compared to the same quarter last year. As a result, TTD generated significantly higher free cash flow since SBC is a non-cash expense. Nevertheless, it is dilutive to shareholders.

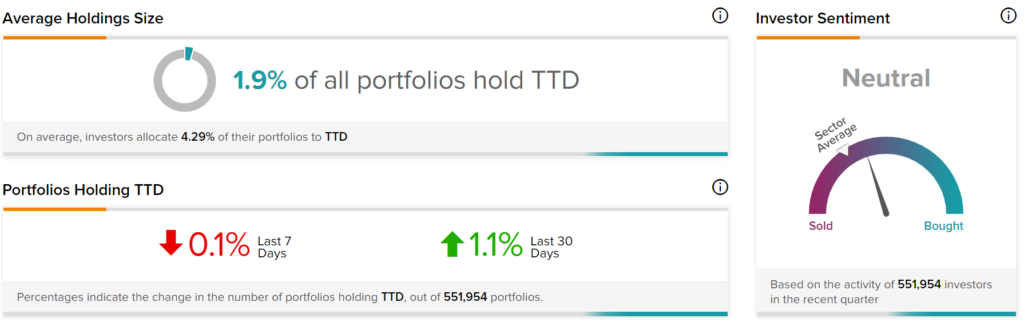

Investor Sentiment is Above Sector Average

The sentiment among TipRanks investors is currently neutral. Out of the 551,954 portfolios tracked by TipRanks, 1.9% hold TTD. In addition, the average portfolio weighting allocated towards TTD among those who do have a position is 4.29%. This suggests that investors of the company are quite confident about its future.

Furthermore, in the last 30 days, 1.1% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

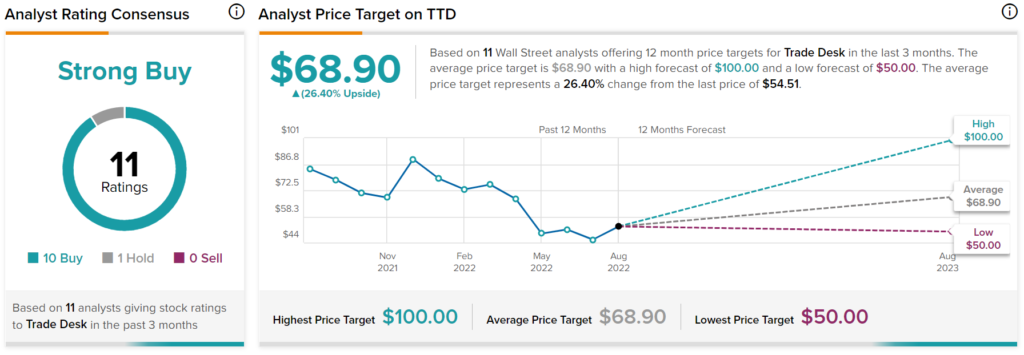

What is the Target Price for TTD Stock?

TTD has a Strong Buy consensus rating based on 10 Buys and one Hold assigned in the past three months. The average TTD price target of $68.90 implies 26.4% upside potential.

Final Thoughts – Customer Loyalty Will Help Navigate Uncertainty

The Trade Desk saw strong growth in the second quarter, as sales grew by 35% despite the macroeconomic uncertainty. Therefore, the company has shown that its customers view its services as critical because they are not reducing spend on its platform during a period of falling advertising budgets. Therefore, this loyalty will help The Trade Desk navigate through difficult economic times.