Tronox Holdings announced on Dec. 27, that its Chairman and CEO Jeffry N. Quinn will leave with immediate effect.

The move comes just after Quinn notified the chemical company’s board on Dec. 24, that he had been mentioned as an unnamed individual in an SEC civil and criminal complaint accused of alleged insider trading related to activities in the shares of Ferro Corp. during February and March of 2016.

Tronox Holdings (TROX) EVPs, John D. Romano and Jean-François Turgeon were appointed as interim co-CEOs, effective immediately. While serving as interim co-CEOs Romano and Turgeon will maintain their current responsibilities as EVPs.

Lead independent director Ilan Kaufthal was elected as the interim Chairman of the Board, effective immediately.

After speaking with the company, Alembic Global analyst Hassan Ahmed on Dec. 28 reiterated a Buy rating on the stock with a price target of $15. Ahmed noted “that the timeline of events and the fact that neither Tronox nor Tronox’s shares are referenced in the SEC complaints are highly relevant to this announcement.”

“Based on the facts that we know the investigation seems to be exclusively focused on shares in Ferro and that too during a time period that pre-dates Mr. Quinn being CEO of Tronox – allaying fears, in our view, of any wrongdoing at Tronox,” Ahmed wrote in a note to investors.

“Additionally, the announcement of two Tronox senior executives as Co-CEO’s ensures a seamless continuation of corporate strategy,” the analyst said. “We continue to believe TiO2 fundamentals are revving up with Tronox shares highly undervalued on a normalized valuation basis. We would use any weakness in Tronox share price based on this news as a buying opportunity.” (See TROX stock analysis on TipRanks)

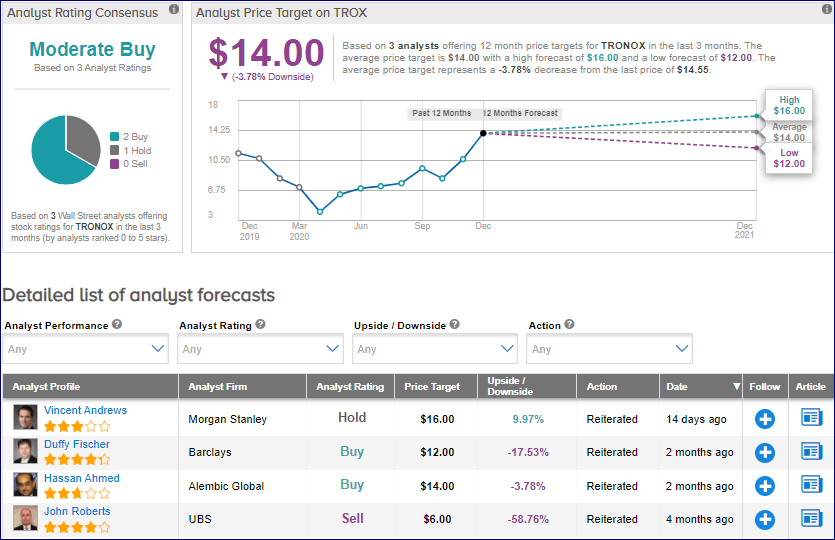

From the rest of the Street, the stock scores a cautiously optimistic analyst consensus of a Moderate Buy based on 2 Buys and 1 Hold. The average analyst price target of $14 implies downside potential of 3.8% to current levels. Shares have already gained 27.4% year-to-date.

Related News:

Gazprom Says Production is Set to Decline; Street Sees 6% Downside

Ayr Strategies Acquires CannTech For $57.4M; Street Sees 34% Upside

Rio Tinto and PKKP Rebuild Relations After Juukan Gorge Destruction; Shares Up 28% YTD