Trevali Mining Corporation (TSX: TV) reported disappointing second-quarter 2022 operating and financial results. The poor quarterly performance caused the share price to fall over 50% on Tuesday. This pushed Trevali Mining’s year-to-date share price decline to almost 75%.

With a market cap of C$35.26 million, Trevali is a global base-metals mining company. Headquartered in Vancouver, the company has 90%-ownership in each of the Perkoa and Rosh Pinah mines. Moreover, it completely owns the Caribou mine.

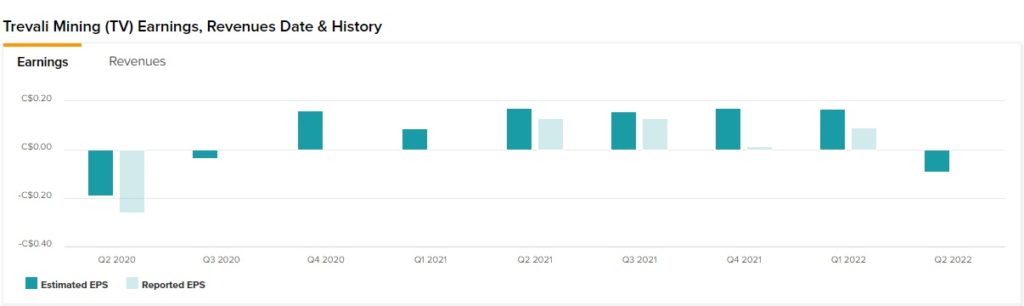

Trevali Mining Misses Earnings Expectations

The mining company’s net loss came in at -$0.63 per share, against the year-ago period’s earnings of $0.04 per share. As a result, Trevali Mining missed analysts’ expectations of -$0.09 per share in the quarter.

The company had charged a non-cash, after-tax impairment of $23.7 million on the Perkoa and Caribou operations and Perkoa’s near-mine exploration asset.

Impairment charges symbolize a decline in the carrying value of any particular asset on a balance sheet.

The company’s revenues in the reported quarter came in at $52 million, declining 44% from the prior year’s period due to operational challenges in the Perkoa and Caribou mines. Trevali Mining reported adjusted EBITDA of $9.2 million in the second quarter of 2022, down 78% year-over-year.

Operational challenges in the Perkoa and Caribou mines, which were partially offset by strength in the Rosh Pinah mines, resulted in a decline in zinc payable production to 34.5 million pounds from 87.3 million pounds in the year-ago period.

Net Debt came in at $59.4 million at the end of the second quarter from $81.8 million on March 31, 2022.

The mining company initiated a strategic review process in the second quarter of 2022, where it considered an investment in Trevali and the chances of a complete or partial sale of the business and assets of Trevali. Moreover, the company expects to default on a prepayment of nearly $7.5 million on its revolving credit facility that is due on August 17.

Trevali Mining has revised its full-year 2022 outlook for the Rosh Pinah mine. Production is expected to be between 62 million and 66 million pounds of payable zinc, with a C1 Cash Cost of $0.84 – 0.90/lb, and all-in sustaining costs are expected in the range of $1.22 – $1.28/ lb.

The company has not given Caribou mine’s full-year production and cost outlook due to persistent operational performance challenges arising from low productivity rates and equipment and operator availability from the mining contractor.

Moreover, the operating cost and production outlook for the Perkoa mine continue to be suspended following the halting of mining and milling operations in the facility due to a flooding event on April 16. The flooding mishap cost the company around $15.2 million in the reported quarter.

Is Trevali Mining a Good Stock?

Turning to Wall Street, analysts seem to be cautiously pessimistic about Trevali Mining, which has a Moderate Sell rating based on five Holds and two Sells assigned in the past three months. However, the average Trevali Mining price target of C$0.80 implies 272.3% upside potential.

It’ll be interesting to see if analysts will downgrade the stock following the disappointing quarter.

Conclusion: Is TV Stock in Trouble?

The mining company is exposed to headwinds of rising costs amid high inflation levels and severe operational challenges. Also, it is cautioning about the chance of defaulting on a credit facility. Therefore, it’s reasonable to say that TV stock is indeed in trouble.