Trade Desk, Inc. (TTD) delivered better-than-expected third-quarter numbers on the back of strong momentum in ad spending by clients across the globe. The company provides a self-service cloud-based platform for buyers of advertising in various ad formats and devices.

Let us take a look at what’s changed in TTD’s key risk factors that investors should know.

Risk Factors

According to the new TipRanks’ Risk Factors tool, TTD’s top risk category is Finance & Corporate, which accounts for 28% of the total 50 risks identified. In its recent Q3 report, the company has changed one key risk factor under the Tech & Innovation risk category.

TTD notes that it allows customers to make use of application programming interfaces (APIs) with its platform, which may lead to a breach of security or outages and adversely impact TTD’s business and operations.

TTD’s APIs enable clients to build their own media and data management interface, and the use of its APIs has grown substantially in recent years. This exposes TTD to security and operational risks, and overuse of its systems, which can potentially result in outages. The company has also witnessed system slowdowns due to the overuse of its systems by clients. (See Insiders’ Hot Stocks on TipRanks)

TTD has taken steps to reduce security and outage risks related to API use, but there is no guarantee that these actions will be successful.

The company’s Tech & Innovation risk factor is at 18%, compared to the sector average of 14%.

Wall Street’s Take

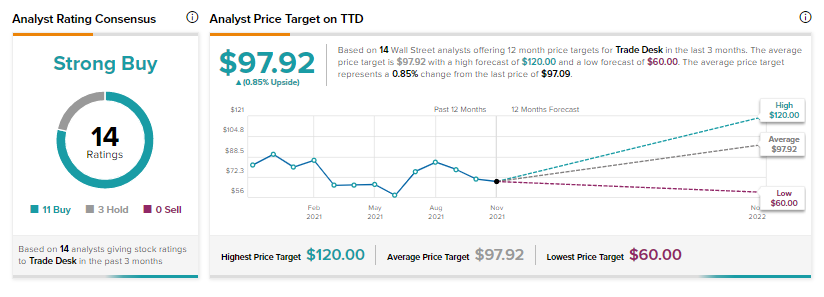

On November 9, Wells Fargo analyst Brian Fitzgerald reiterated a Buy rating on the stock and increased the price target to $120 from $115.

The analyst views TTD favorably amid potential catalysts, including Walmart connect, UID adoption, international, CTV, linear programmatic, 2022 political spend, and incremental Solimar adoption.

Consensus on the Street is a Strong Buy based on 11 Buys and 3 Holds. The average Trade Desk price target of $97.92 implies that the stock is fairly priced at current levels. Shares of the company have gone up 25.5% so far this year.

Related News:

PayPal Delivers Mixed Q3 Results; Issues Guidance

Goodyear Tire & Rubber Q3 Results Top Estimates

Tencent Music Posts Mixed Q3 Results