Shares of outdoor equipment products provider The Toro Company (NYSE:TTC) surged nearly 10% today after its fourth-quarter results exceeded expectations. Despite a 16% year-over-year decline, revenue of $983.2 million landed ahead of estimates by $9.5 million. Similarly, EPS of $0.71 outpaced consensus by $0.15.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Net sales for the full year rose to $4.55 billion from $4.51 billion in 2022. Toro’s Fiscal 2023 was marked by strength in underground and specialty construction, as well as golf and grounds businesses. In the fourth quarter, the company adapted to changing business conditions by increasing output in verticals with elevated backlogs while lowering production in its residential and professional lawn care solutions.

At the same time, higher material costs and inventory reserves impacted its margins in the fourth quarter. While demand in key professional markets remains strong, a rebound is expected in Toro’s homeowner markets. For Fiscal Year 2024, the company expects net sales growth in the low-single-digit. EPS for the year is seen landing between $4.25 and $4.35.

Additionally, Toro has launched a multi-year productivity initiative. The program is expected to lead to annualized cost savings of over $100 million by Fiscal Year 2027.

Is TTC a Good Stock to Buy?

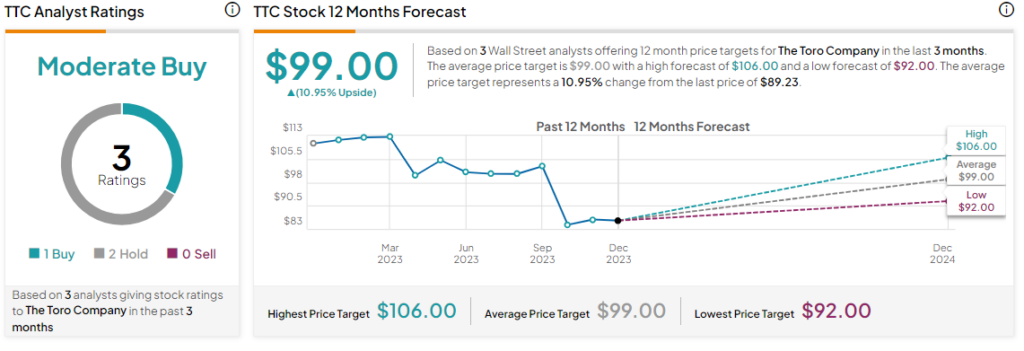

Overall, the Street has a Moderate Buy consensus rating on The Toro Company. Following a nearly 20% slide in the company’s share price over the past year, the average TTC price target of $99 points to a modest 11% potential upside in the stock.

Read full Disclosure