Shares of the digital technology platform built for restaurants, Toast (NYSE:TOST) crashed in pre-market trading after the company reported earnings for its third quarter of FY23. The company’s losses narrowed in Q3 to a loss of $0.06 per share as compared to a loss of $0.19 per share in the same period last year Analysts were expecting the company to report earnings of $0.02 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Toast’s revenues grew 37% year-over-year to $1.03 billion, in-line with analysts’ expectations.

Toast CEO Chris Comparato commented, “Toast delivered solid results in the third quarter. ARR [annualized recurring run rate] grew 40% to over $1.2 billion with our consistent go-to-market execution driving strong net location additions combined with continued ARPU [average revenue per user] growth.”

Comparato will make way for Aman Narang, the new CEO of Toast who will take over from January 1, 2024. Comparato will continue being a Board member.

Looking forward, management now expects revenue and adjusted EBITDA in the fourth quarter to be in the range of $1 billion to $1.03 billion and between $5 million and $15 million, respectively. In FY23, Toast’s revenues are projected to be in the range of $3.83 billion to $3.86 billion while adjusted EBITDA is likely to be between $38 million and $48 million. The company’s full-year revenue forecast is narrower than its prior outlook in the range of from $3.81 billion to $3.87 billion.

Is TOST a Good Stock?

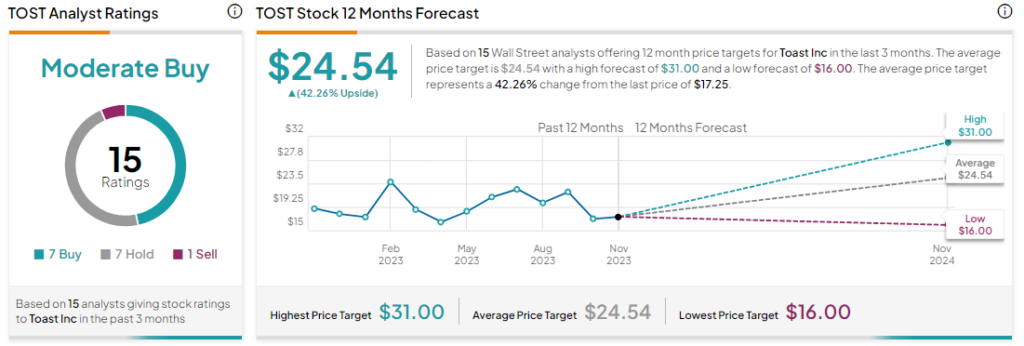

Analysts are cautiously optimistic about TOST stock with a Moderate Buy consensus rating based on seven Buys and Holds each and one Sell. The average TOST price target of $24.54 implies an upside potential of 42.3% at current levels.