Canadian cannabis stock Tilray (TLRY) has announced that it is shutting High Park Gardens, a licensed cannabis greenhouse in Leamington, Ontario. As a result of the closure, Tilray hopes to save about $7.5 million per year (current production costs net of future 3rd party purchases and ongoing depreciation) and avoid “significant” ongoing capital expenditures.

Tilray acquired Natura Naturals Inc, which has since operated as High Park Gardens, in 2019 in a $50.8M deal. The Ontario-based facility contains 406,000 square feet of Health Canada licensed space for cannabis cultivation and manufacturing, ands primarily serves the adult-use market in Canada.

“We are continuously evaluating the evolving needs of our business, against a challenging industry backdrop, to ensure we’re in the best position to produce world-class products and deliver positive results for our stakeholders,” commented Brendan Kennedy, Tilray CEO.

“The decision to close a facility is never easy but we are confident that this will immediately put Tilray in a better position to achieve our goals of driving revenues across our core businesses and working towards positive adjusted EBITDA by the end of 2020” he continued. Tilray will continue to use its existing facilities in Ontario to serve the adult-use market in Canada.

Shares in Tilray have plunged 37% year-to-date, although the stock spiked 5% on May 26 after New York Governor Andrew Cuomo announced that he intends to enact marijuana legalization “in the near future.”

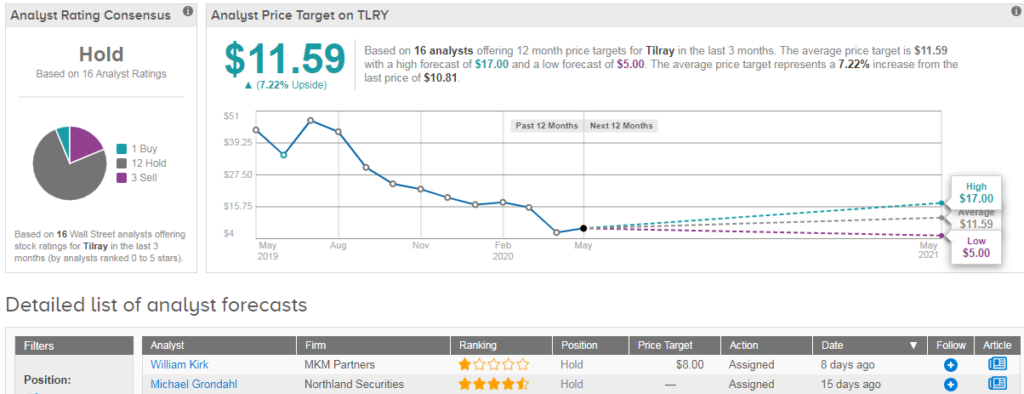

Analysts have a very cautious outlook on Tilray, with a Hold consensus made up of 12 recent buy ratings, and 3 sell ratings vs just 1 buy rating. The average analyst price target stands at $12 (7% upside potential).

MKM Partners analyst William Kirk has a hold rating on Tilray with an $8 price target (26% downside potential). He writes: “With narrower EBITDA losses than some peers and a near-term profitable opportunity in Israel, Tilray has a better chance to reach positive EBITDA.”

But the analyst adds, “to achieve it: 1) topline needs to grow; 2) gross margins need to improve; and 3) absolute SG&A needs to be flat. Given the industry’s excess inventory levels, we consider this an unlikely combination of events.” (See Tilray stock analysis on TipRanks).

Related News:

Why Aurora Cannabis (ACB) Stock Looks Attractive

Uncertainty Remains Even After Aurora’s U.S. Market Debut, Says Analyst

Debenture Conversion Isn’t Enough to Offset Cash Struggles, Says Hexo Bear