Tiffany & Co. released its preliminary sales results yesterday for the holiday period between November 1 and December 31, 2020. Compared to the same period in 2019, Tiffany showed an unaudited worldwide net sales increase of approximately 2%. This represents the highest net sales results for the holiday period since the company was founded in 1837.

Tiffany’s (TIF) online sales grew more than 80% compared to the same period the year before as consumers were forced to change their shopping habits due to the coronavirus pandemic.

Mainland China was the main driver behind the growth in sales, with a more than 50% increase year-on-year, but Net Sales in Europe and the U.S. dropped off 8% and 5%, respectively.

Tiffany’s Chairman of the Board, Roger Farah, praised Chief Executive Officer, Alessandro Bogliolo, for his achievements over the past three years of elevating and modernizing the Tiffany’s brand.

Bogliolo said, “This year has certainly stress tested the corporate strategies we set in 2017 to strengthen the Brand and win in the highly competitive global luxury jewelry market.”

Tiffany, who operates 320 stores globally and employs over 14,000 people including more than 5,000 skilled artisans, recently announced that it had accepted an offer valued at $16 billion to merge with LVMH. (See TIF stock analysis on TipRanks)

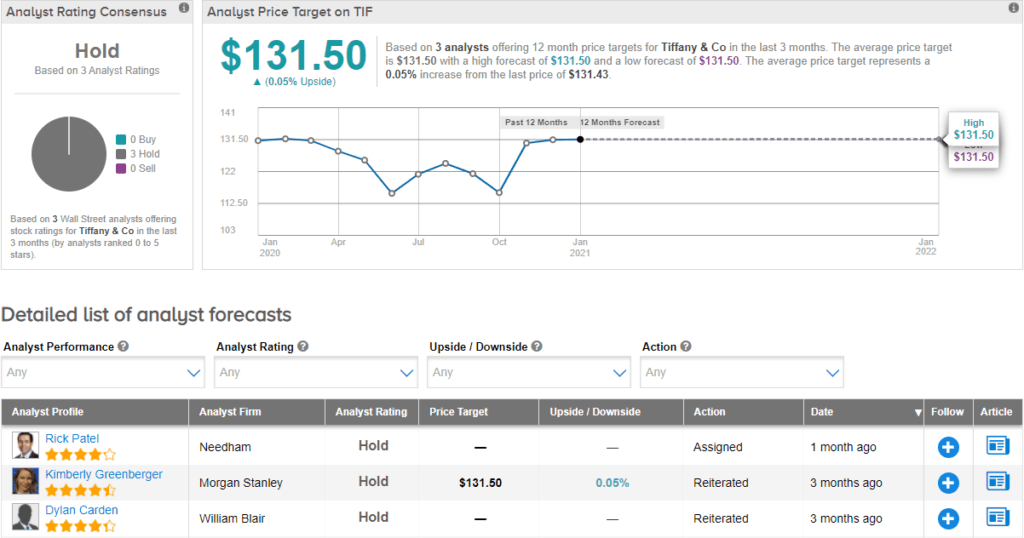

Morgan Stanley analyst Kimberly Greenberger reiterated a Hold rating on the stock recently and set her price target at $131.50, which is in-line with the purchase price agreed with LVMH.

Commenting on the merger, Greenberger said, “We continue to see solid strategic rationale, as Tiffany’s status as a dominant luxury brand, global expansion potential, and pricing power make it a fundamentally attractive business.”

Consensus among analysts is a Hold based on 3 Holds ratings over the past three months. The average price target of $131.50 suggests that TIF shares are fully priced at current levels.

Related News:

Smart Global Tops 1Q Estimates; Street Is Bullish

Range Resources Increases Debt Offering To $600M; Shares Climb 4%

Hologic To Buy Biotheranostics For $230M; Top Analyst Sticks To Hold