Thor Industries reported record second-quarter results ended Jan. 31, 2021. The owner of recreational vehicle subsidiaries delivered a 36% year-on-year increase in net sales to $2.73 billion, beating analysts’ estimates of $2.53 billion.

Thor (THO) has beaten consensus earnings estimates over the last four quarters with the most recent EPS of $2.38 coming in ahead of forecasts of $1.60. Net income grew 362% year-on-year to $132.5 million.

“In our quarter ended January 31, 2021, we delivered record results for a fiscal second quarter, which is typically our lowest sales quarter,” said Bob Martin, President and CEO of THOR Industries.

Looking ahead to the remainder of 2021, Martin sees demand for Thor’s products outpacing supply. With a backlog of orders at record levels, the company is investing in areas that will allow it to “increase production capacity while enhancing our quality processes.”

Martin also credits a shift in trends for the continued expansion of the industry. He says that millennials are buying RVs earlier than previous generations and the work-from-anywhere environment has resulted in many more people choosing RVs as their mobile offices. (See Thor Industries stock analysis)

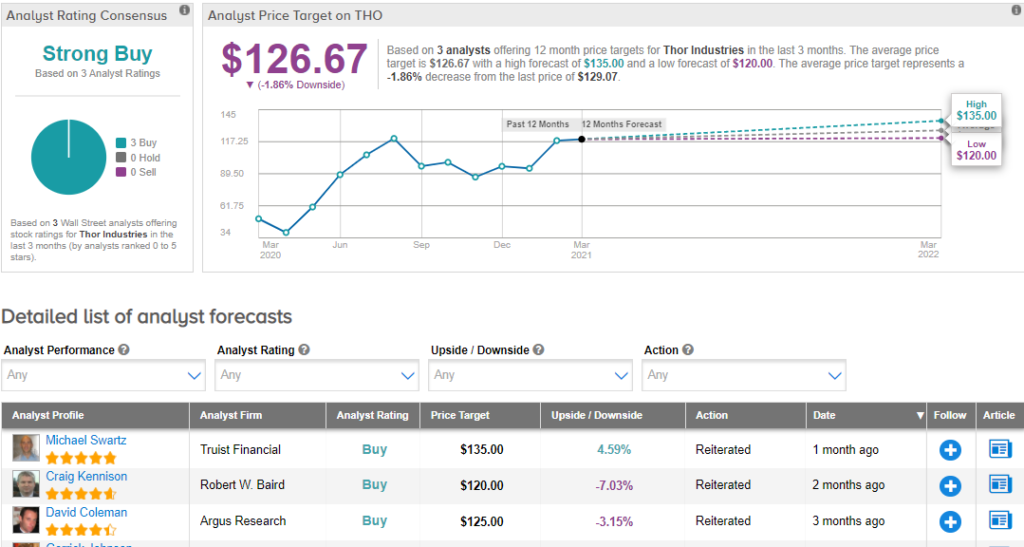

Last month, Truist analyst Michael Swartz reiterated a Buy rating on THO and raised his price target to $135 from $120. This implies upside potential of around 5% over the next 12 months.

Swartz raised his FY21 EPS estimate by $0.40 as a result of the Tiffin acquisition together with increasing his expectations of Q2 shipment volumes.

Consensus among analysts is a Strong Buy based on 3 unanimous Buy recommendations. The average analyst price target of $126.67 suggests that shares are fully priced at current levels with around 2% downside potential.

Related News:

Stitch Fix Plummets 22% In Pre-Market On Softer FY21 Revenue Outlook

Waitr Disappoints With 4Q Results; Shares Slide 15%

Benefitfocus’ 1Q Sales Outlook Misses Estimates After 4Q Beat