BigBearAI (NYSE:BBAI) is certainly a nominee for one of the most volatile stocks of the year. The year kicked off with a bang, as shares more than doubled in the first six weeks – only to plunge ~75% by late April. Then came an explosive rebound, with the stock surging more than 270% by mid-October. And yet, in classic BigBear fashion, momentum faded again, sending shares down about 22% in recent weeks. For investors, it’s been a roller-coaster saga, driven by ambitions of becoming the next Palantir and tempered by broader macro uncertainty.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Those hopeful that BBAI will enjoy stratospheric growth à la Palantir can point to the company’s AI-powered technology, which is already employed in national security projects. Moreover, the One Big Beautiful Bill will channel billions of dollars into defense and security initiatives, and BBAI could emerge as one of the beneficiaries of this government spending.

Yet, the bears have their arguments too. In the last reported quarter, Q2 revenue fell 18% year-over-year, pushing the company to cut its full-year outlook. At the same time, losses ballooned – BigBear posted a net loss of $228.6 million in Q2, compared with a $14.4 million loss in the prior-year period.

“Can a company bleeding that much cash still be a buy or are investors walking straight into a trap?” wonders top investor Rick Orford, who is among the top 1% of stock pros covered by TipRanks.

To be fair, Orford gives credit where it’s due. He highlights that BigBear’s AI security and analytics tools aren’t just speculative ideas on a pitch deck – they’re embedded in mission-critical government and industry systems today, offering real-world validation of the company’s technology.

BBAI has multiple contracts with the U.S. government, which speaks to the faith that these agencies are placing in the company’s wares. Orford further notes that the company’s technology is now providing “frictionless user experiences” in the private sector as well.

“When your clients include the U.S. government, failure isn’t just expensive, it’s unacceptable,” emphasizes Orford.

And yet, the company isn’t turning a profit, concedes Orford. However, the investor does add that BBAI’s strong cash position should give it a decent amount of runway to keep the lights on as it strives for profitability.

And that’s where push will come to shove for BBAI, explains Orford: “How they deploy that cash next could decide if BigBear becomes the next Palantir or the next penny stock.” (To watch Rick Orford’s track record, click here)

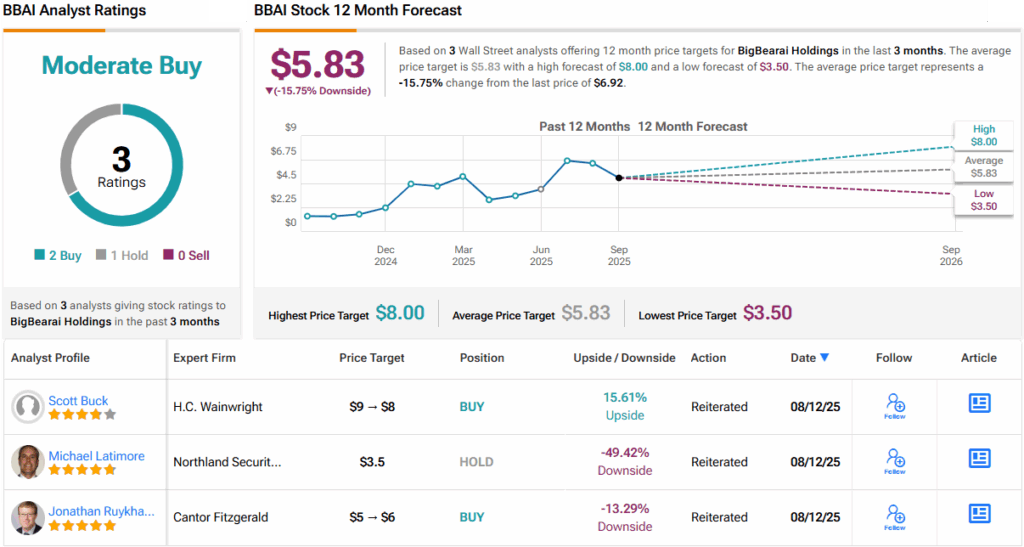

While BBAI has no shortage of attention from retail investors, the story looks different on Wall Street. BBAI still flies under the radar, with only 3 analysts officially tracking it. Among them, the breakdown stands at 2 Buys and 1 Hold, giving BBAI a Moderate Buy consensus. However, the average price target of $5.83 actually points to ~16% downside from current levels. (See BBAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.