In times of market turmoil, time-tested companies offer safer bets for investors. While price gyrations may continue, dividend investing provides a steady income stream. The TipRanks dividend calendar is a powerful tool that can help you stay on top of stocks offering dividends and their ex-dividend dates, while also allowing you to track dividend stocks by sector or market cap across listed companies in the U.S., Canada, and U.K.

Knowledge about the ex-dividend dates is crucial in dividend investing. Only those investors who purchased stock before this date will receive the dividend payment. Let’s have a look at the top stocks going ex-dividend this week.

Johnson & Johnson (JNJ)

JNJ goes ex-dividend today. The company is paying a dividend of $1.12 per share, implying a dividend yield of 2.43%. The consensus estimate on the Street for JNJ at present remains a Moderate Buy. The average analyst price target of $192.91 implies a potential upside of 9.70% for JNJ.

Applied Materials (AMAT)

AMAT goes ex-dividend on May 25 and the company is paying a dividend of $0.26 per share, implying a dividend yield of 0.92%. The consensus estimate on the Street for AMAT is a Moderate Buy. The average analyst price target of $148.05 implies a potential upside of 39.07% for AMAT.

Barrick Gold (GOLD)

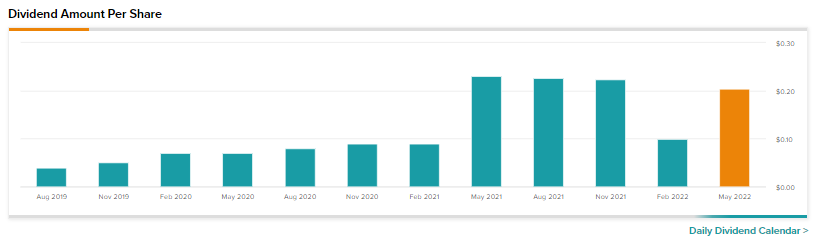

GOLD goes ex-dividend on May 26 and the company is paying a dividend of $0.2 per share, implying a dividend yield of 3.6%. The consensus estimate on the Street for GOLD is a Moderate Buy. The average analyst price target of $28.55 implies a potential upside of 37.52% for GOLD.

NextEra Energy (NEE)

NEE went ex-dividend on May 2 and the company is paying a dividend of $0.42 per share, implying a dividend yield of 2.27%. The consensus estimate on the Street for NEE is a Strong Buy. The average analyst price target of $92.31 implies a potential upside of 29.61% for NEE.

Skyworks Solutions (SWKS)

SWKS too goes ex-dividend today. The company is paying a dividend of $0.56 per share, implying a dividend yield of 2.17%. The consensus estimate on the Street for SWKS is a Moderate Buy. The average analyst price target of $147.38 implies a potential upside of 43.87% for SWKS.

Kraft Heinz (KHC)

KHC goes ex-dividend on May 26 and the company is paying a dividend of $0.4 per share, implying a dividend yield of 4.17%. The consensus estimate on the Street for KHC is a Hold. The average analyst price target of $42.33 implies a potential upside of 10.32% for KHC.

AGNC Investment (AGNC)

AGNC goes ex-dividend on May 27 and the company is paying a dividend of $0.12 per share, implying a whopping dividend yield of 12.14%. The consensus estimate on the Street for AGNC is a Moderate Buy. The average analyst price target of $12.57 implies a potential upside of 6.89% for AGNC.

Lumen Technologies (LUMN)

LUMN goes ex-dividend on May 27 and the company is paying a dividend of $0.25 per share, implying a robust dividend yield of 9.04%. The consensus estimate on the Street for LUMN is a Moderate Sell. The average analyst price target of $10.38 implies a potential downside of 6.15% for LUMN.

DuPont de Nemours (DD)

DD goes ex-dividend on May 27 and the company is paying a dividend of $0.33 per share, implying a dividend yield of 1.97%. The consensus estimate on the Street for DD is a Strong Buy. The average analyst price target of $88.50 implies a potential upside of 38.61% for DD.

Closing Note

Dividend investing remains an all-weather way of investing that combines a steady income stream with possible share price gains. As growth stocks continue to take a beating, investor attention will no doubt go to stocks that have been paying out dividends consistently.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Macro Headwinds Hurt Kohl’s Q1 Performance

Why Did Shares of Children’s Place Gain 10% Despite Q1 Miss?

Foot Locker Gains 6% Despite Mixed Q1 Results