Shares of Tetra Tech, Inc. (TTEK) jumped 3.5% on Thursday after the provider of high-end consulting and engineering services announced an additional stock repurchase program of $400 million. The new authorization is twice the previous share buyback plan.

Markedly, along with the remaining amount of share repurchase authorization as of the third quarter of Fiscal 2021, the company now has a total amount of $563 million for share repurchases.

Over the period of 12 months ending third quarter of Fiscal 2021, Tetra Tech recorded cash flow from operations worth $294 million. Notably, it returned $98 million to shareholders through share repurchases and dividends during this period.

See Top Smart Score Stocks on TipRanks >>

Tetra Tech CEO Dan Batrack said, “The strength of our balance sheet and strong consistent cash flow generation will allow us to continue investing in both organic growth initiatives and strategic acquisitions while having greater capacity to return more capital to shareholders.” (See Tetra Tech stock charts on TipRanks)

Recently, Sidoti analyst Marc Riddick increased the price target on Tetra Tech to $199 (25.6% upside potential) from $190 while maintaining a Buy rating.

Following the third-quarter Fiscal 2021 results in July, Maxim Group analyst Tate Sullivan reiterated a Buy rating on the stock with a price target of $162 (2.3% upside potential).

In a report, Sullivan stated, “We believe demand will increase for TTEK’s environmental consulting services due to more government regulation, and that TTEK will continue to integrate higher-margin data analytics work into water, environment, and infrastructure consulting projects.”

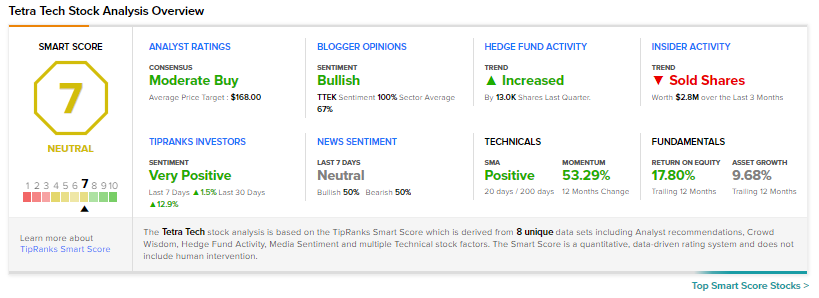

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 2 Buys and 1 Hold. The average Tetra Tech price target of $168 implies 6.05% upside potential to current levels. Shares have surged 55.1% over the past year.

According to TipRanks’ Smart Score rating system, Tetra Tech gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

EMA Approves Moderna’s Third Dose of COVID-19 Vaccine

SunPower Snaps Up Blue Raven Solar for $165M

Boston Scientific Inks $1.75B Deal to Acquire Baylis Medical