Tesla, Inc. (NASDAQ: TSLA), one of the foremost names among EV stocks, has reported better-than-expected results for the quarter ended December 31, 2021. A robust growth witnessed in revenues was primarily responsible for the strong results.

Following the news, shares of the company declined marginally to close at $929.90 in Wednesday’s extended trading session.

Revenue & Earnings

Tesla reported quarterly revenues of $17.72 billion, up 65% from the previous year. Further, the figure surpassed the consensus estimate of $16.35 billion. This growth can be attributed mainly to the 71.4% year-over-year growth witnessed in automotive revenues, which also accounted for over 90% of the total revenues of the company.

The company’s earnings per share (EPS) for the quarter stood at $2.54, up 218% from the prior year. The figure also surpassed the consensus estimate of $2.26 per share.

Other Operating Metrics

Meanwhile, Tesla reported total deliveries of 308,650 vehicles for the quarter, which compares favorably to the 180,667 deliveries in the previous year.

The company’s operating margin and adjusted EBITDA margin improved from 5.4% and 17.2% in the prior year to 14.7% and 23.1%, respectively.

Stock Rating

On January 26, CFRA analyst Garrett Nelson reiterated a Buy rating on the stock. The analyst however, raised the price target from $1,250 to $1,300, which implies upside potential of 38.7% from current levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 15 Buys, 8 Holds and 7 Sells. The average Tesla price target of $1,076.62 implies that the stock has upside potential of 14.9% from current levels. Shares of the company have gained about 8.5% over the past year.

Website Traffic

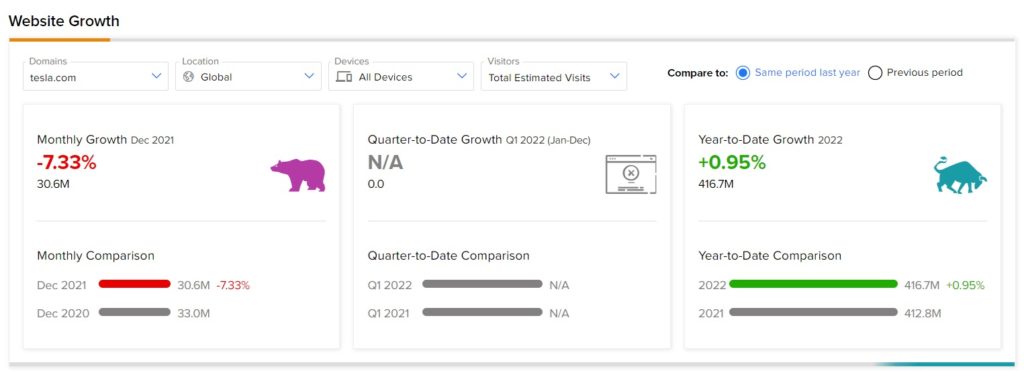

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Tesla’s performance this quarter.

According to the tool, the Tesla website recorded a 7.33% monthly decline in global visits in December, compared to the same period last year. Yet, year-to-date, the website traffic has increased 0.95%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Texas Instruments Shares Gain 3.7% on Strong Q4 Results

Uber Partners with Smart & Final to Boost West Coast Deliveries

Meta to Launch Fastest AI Supercomputer by Mid-2022