Tesla Inc.’s (TSLA) billionaire founder Elon Musk qualified on Tuesday for a payout worth more than $2 billion, his second jackpot since May from the electric car maker as the stock surged a whopping 275% this year.

Tesla’s stock was down 4.5% at the close on Tuesday, trimming the rally that has propelled the company’s market capitalization to over $290 billion, larger than any other carmaker.

Despite Tuesday’s stock decline, Tesla’s six-month average market capitalization for the first time has reached $150 billion, according to a Reuters report. That triggers the vesting of the second of 12 tranches of options granted to the billionaire in his 2018 pay package to buy Tesla stock at a discount.

In early May, Musk’s first tranche vested after Tesla’s six-month average stock market value reached $100 billion. Musk has already achieved targets related to Tesla’s financial growth that are also needed in order to vest the latest options tranche.

Each tranche gives Musk the option to buy 1.69 million Tesla shares at $350.02 each, less than a quarter of their current price. At Tesla’s current stock price of $1,568.36, Musk would theoretically be able to sell the shares related to the current tranche for a profit of more than $2 billion.

Backed by higher-than-expected second-quarter vehicle deliveries, some investors are betting that Tesla might report a profit in its second-quarter results on Wednesday after the bell. That would mark four consecutive profitable quarters, a first for Tesla and a key hurdle for it to be added to the S&P 500 index.

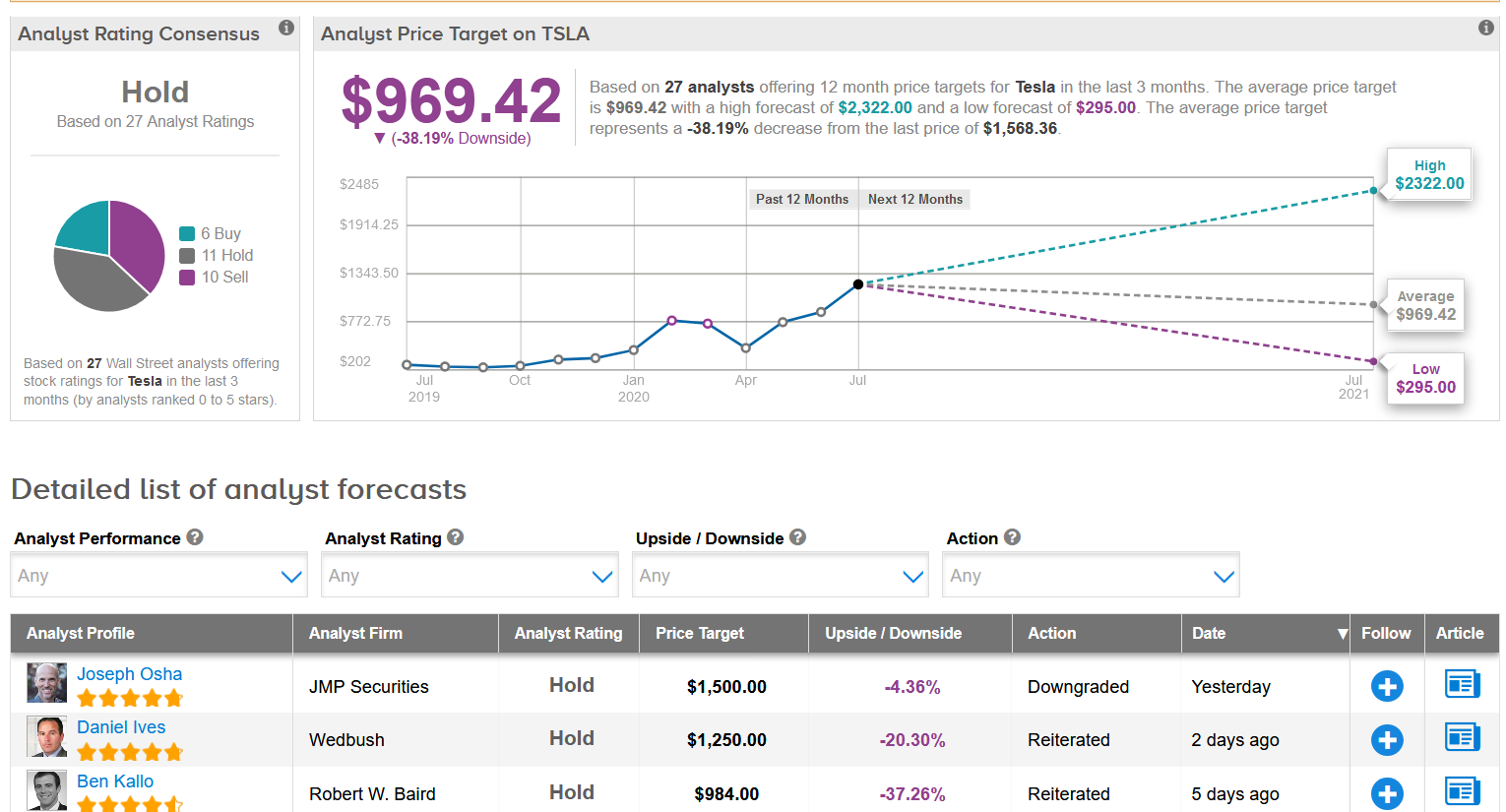

Ahead of the earnings report, JMP Securities analyst Joseph Osha cut the stock’s rating to Hold from Buy with a $1,500 price target (4.4% downside potential), saying that the share has gone far enough to reflect the company’s performance.

“We continue to believe that [Tesla] can become a $100 billion [in sales] car company by 2025, but we cannot arrive at a reasonable basis for arguing that the stock should be valued above current levels, even considering our fundamental outlook,” wrote Osha in a Tuesday research report.

In line with Osha’s outlook, the majority of Wall Street analysts are sidelined on the stock with a Hold analyst consensus. In view of this year’s strong rally, the $969.42 average analyst price target now implies 38% downside potential for the shares in the coming 12 months. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla Is Said To Push For Record Q3 Deliveries; Shares Rise In Pre-Market

The Fate of Nikola (NKLA) Stock Remains Up in the Air

Tesla’s Elon Musk Overtakes Buffett On Billionaires Rich List