Tesla Inc. (TSLA) will be granted millions of dollars in tax subsidies from a central Texas county that includes Austin, if it builds a $1.1 billion vehicle factory in the area.

Shares rose 2.2% to $1,550.02 in Wednesday’s pre-market trading after a majority of commissioners in Travis County voted in favor of providing the electric carmaker with a tax rebate worth at least $14.7 million dependent on meeting certain milestones, Reuters reported.

The decision to approve the tax breaks marks a step forward for Texas as it vies with Oklahoma to attract a new factory to build Tesla’s Y sport utility vehicles and cybertrucks.

The electric carmaker has only one vehicle manufacturing plant in California and has been seeking to start building a large second plant in the southwestern United States as early as the third quarter of this year.

Tesla has demanded Travis County for an 80% rebate on its property taxes for 10 years, worth $14.7 million, as well as a 65% rebate for the next 10 years after that. The electric carmaker said the factory would create 5,000 jobs, mostly low-skilled.

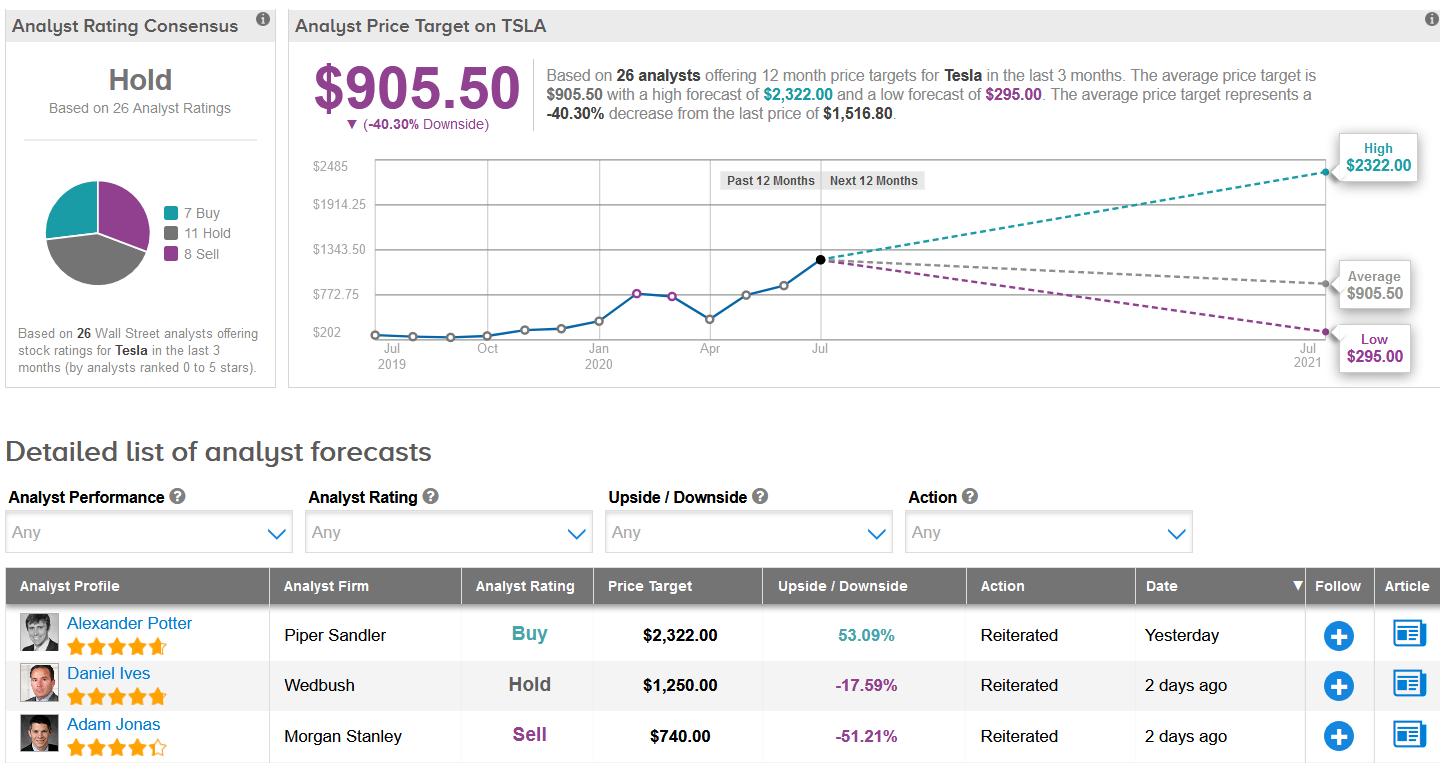

Shares of the electric carmaker have jumped a stellar 262% this year with the majority of Wall Street analysts staying sidelined on the stock with a Hold analyst consensus.

Barclays analyst Brian Johnson who has a Hold rating on Tesla with a $300 price target (80% downside potential) believes the stock is “overvalued” and has more room to run, and therefore recommends “bearish friends to remain in the shelter of their caves”.

Commenting on Tesla’s recent car deliveries report, Johnson said that the carmaker “beat a low bar for deliveries (90.6k actual, vs. 70k consensus, we were at 85k), leading to a massive two-day run in the shares.”

“We were above consensus on earnings going into deliveries with the additional 5k deliveries we now forecast $42.0mn GAAP profit – enough to qualify for S&P 500 inclusion,” Johnson wrote in a note to investors. “As a result, while we still believe TSLA is fundamentally overvalued, we see nothing to prevent the shares moving higher in the coming weeks.”

In light of the share’s rally this year, it is not surprising that the $905.50 average analyst price target now implies 40% downside potential to current levels. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla Climbs 6% In Pre-Market, Boosted By ‘Accelerating’ China Projects

Tesla’s Elon Musk Overtakes Buffett On Billionaires Rich List

Tesla Slashes Model Y Crossover Price By $3,000