Tesla (TSLA) will spend more than $1 billion a year acquiring raw materials for developing electric batteries. According to Reuters, the spending drive will mostly target Australia’s mining industry, given the responsible mining practices in play.

The electric vehicle giant gets three-quarters of its lithium supplies from Australia. The country also accounts for more than a third of the company’s nickel demand. Australia should benefit a great deal given the strong demand for electric vehicles and its rising need for energy storage facilities. (See Tesla stock analysis on TipRanks)

“Australian mining companies do have a good reputation, great expertise, professionalism and are preferred by manufacturers increasingly concerned about meeting both today’s and the future’s ESG requirements,” said Robyn Denholm, Tesla Chairwoman.

Reuters reports that the country’s lithium exports are poised to hit $773 million in 2021 with Nickel exports expected to hit $4 billion.

While Tesla gets the raw material for its batteries from Australia, it also supplies the country with batteries used to store energy captured by solar panels.

Morgan Stanley analyst Adam Jonas believes Tesla is well-positioned to profit from the U.S senate passing legislation that would eliminate caps on electric vehicle tax credits.

Jonas stated, “While it may be tempting to pick winners based on who may be eligible for the highest incentive on a ‘per unit’ basis, we believe the biggest beneficiaries of growing and extending BEV incentives will be based on who can produce the most BEVs (and batteries) to meet demand over the next few years.”

The analyst recently reiterated a Buy rating on the stock with a $900 price target implying 48.73% upside potential to current levels.

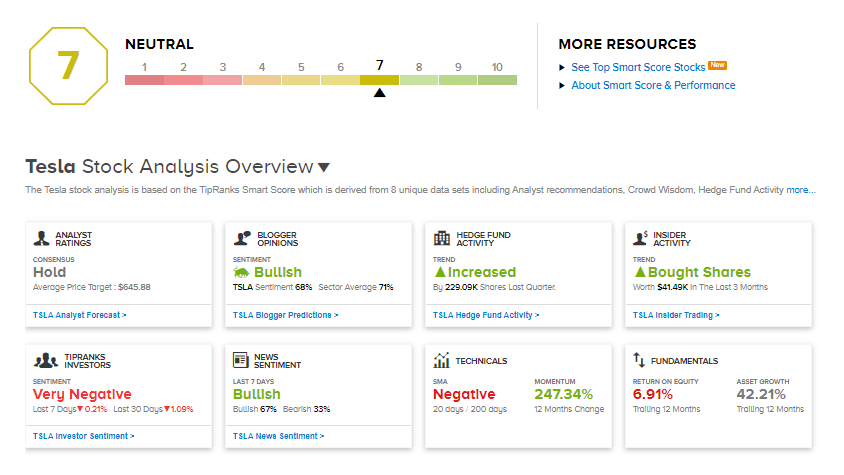

Consensus among analysts on Wall Street is a Hold based on 10 Buy, 8 Hold, and 7 Sell ratings. The average analyst price target of $645.88 implies 6.74% upside potential to current levels.

TSLA scores a 7 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

Pegasystems Becomes Ryder Cup Sponsor, Aims to Grow Brand

Kinder Morgan to Snap up Stagecoach Gas for $1.2B

SS&C Technologies Raises Mainstream Buyout Offer Again