Tesla’s (NASDAQ:TSLA) impressive year-to-date gains in the stock market (up 104%) are somewhat at odds with the real world problems it has faced throughout 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There has been little upward momentum for Model 3/Y deliveries, which have been kept in the ~450,000/qtr range throughout the year. China domestic sales have also hit a brick wall, and Tesla’s share of BEVs has been sliding, falling from 10% to 6% in the last six months.

These are all points made by RBC’s Tom Narayan, who also highlights the challenges Tesla will face in the new year.

“We see headwinds including increased competition causing continued share loss vs. BEV competitors, and TSLA losing half of the US Federal Tax Credit for the RWD and base AWD trims of the Model 3 starting in January due to battery cell sourcing,” the analyst explained.

As such, to factor in more modest growth for the Model 3 and Model Y, Narayan has lowered his delivery estimates for 2024 by 9% and for 2025 by 6%. Specifically for 2024, Narayan now sees Tesla reaching 2.1 million deliveries, the same as consensus and down from his prior 2.3 million forecast. That said, the lowered expectations could mean Tesla’s topline is now “de-risked.”

On other metrics, Narayan’s expectations are below the Street’s; the analyst calling is for 2024 core auto gross margins of 16.7% (consensus has 18.6%), and EBITDA margins of 14.7% compared to the Street’s 16.3% estimate.

That said, there could be several tailwinds that will come into play. These include an ongoing increase in customer awareness boosting the overall demand for BEVs, the refresh of the Model 3 design (and possibly the Model Y) and a “constructive macro outlook” based on interest rates leveling off with low unemployment and moderating inflation providing a healthy backdrop to consumers.

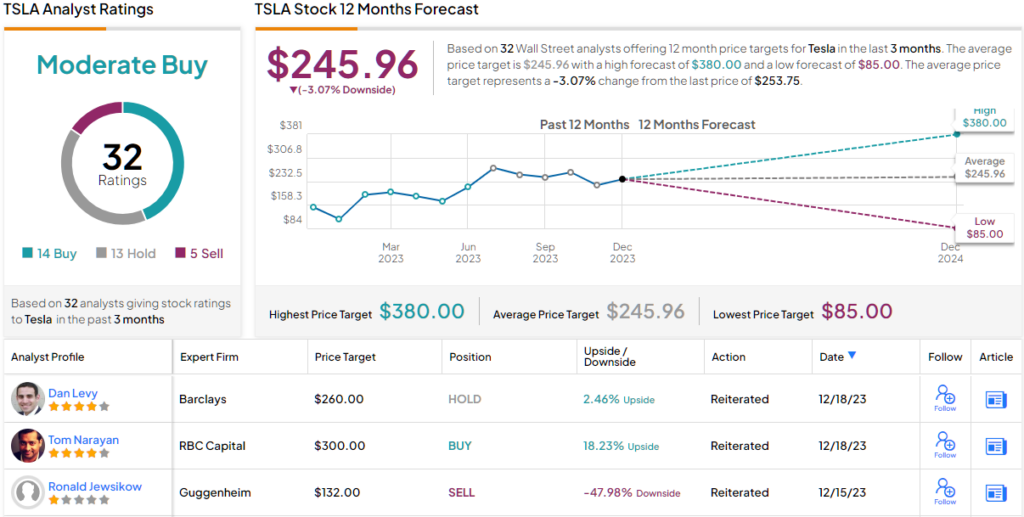

So, what does this all ultimately mean for investors? Narayan reiterated an Outperform (i.e., Buy) rating along with a $300 price target, suggesting shares have room for growth of 17% over the one-year timeframe. (To watch Narayan’s track record, click here)

Tesla almost always elicits a wide spectrum of opinions on Wall Street and that is the case right now. Based on a mix of 14 Buys, 13 Holds and 5 Sells, the stock claims a Moderate Buy consensus rating. However, the $245.96 average target represents downside of 3% from current levels. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.