Elon Musk’s ambitions for Tesla (TSLA) now reach well beyond electric vehicles. The company’s next decade depends on transforming years of artificial intelligence development into profitable, real-world products that can stand beside its cars.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla is already one of the market’s most valuable companies, worth around $1.4 trillion. But Musk’s vision is far bigger. His long-term goal is to push Tesla toward an $8.5 trillion market value and $400 billion in annual earnings before interest, taxes, depreciation, and amortization by 2035, creating what he sees as the first true AI-driven industrial powerhouse.

To achieve that, Tesla must evolve from selling hardware to selling intelligence. Its roadmap revolves around what Musk calls “physical AI,” a category that includes autonomous vehicles, humanoid robots, and adaptive energy systems designed to operate independently.

Tesla’s Future Hinges on Profitable AI Technology

Tesla’s next chapter hinges on whether its AI technology can generate sustainable profit. Musk envisions a network of autonomous cars producing recurring revenue through software subscriptions and robots capable of performing human tasks across industries.

Supporters see this as a brave leap into a new frontier of industrial automation. If it works, Tesla could end up resembling Nvidia (NVDA) or Apple (AAPL) more than any traditional automaker. If it falters, it would expose how much of Tesla’s valuation depends on unproven technology.

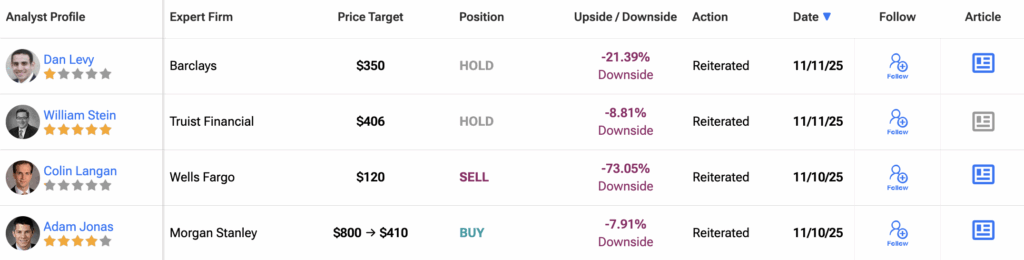

Truist analyst William Stein remains cautious about the timeline. “Physical AI products are still a long way off,” he wrote in a report on Monday, warning that the majority of Tesla’s value rests on projects that currently bring in “close to zero revenue.” Stein maintains a Hold rating and a $406 price target, suggesting most of Musk’s ambitious vision may already be reflected in the stock.

Tesla Mirrors Nvidia’s Leap from Hardware to Intelligence

Tesla’s most optimistic investors often point to Nvidia’s meteoric rise as a case study in how quickly AI can reshape financial reality. The chipmaker’s annual earnings expanded from less than $10 billion to more than $130 billion in just a few years, driven by demand for its GPUs that power AI models worldwide.

Musk aims to achieve a similar breakthrough, but in the physical realm. Instead of chips and servers, Tesla’s focus lies in fleets of self-learning cars, humanoid robots, and AI-powered factories. Each has the potential to unlock new revenue streams, though all remain largely untested.

For now, Tesla’s stock reflects confidence that Musk can pull it off. The coming years will show whether his “physical AI” bet defines the next generation of industrial innovation or reveals how far the future still is.

Is Tesla Stock a Buy, Hold, or Sell?

Analysts remain divided on Tesla’s long-term outlook. Of the 34 Wall Street analysts who have issued ratings in the past three months, 14 rate the stock a Buy, 10 suggest a Hold, and 10 recommend a Sell.

The average 12-month TSLA price target sits at $382.54, which implies a 14% downside from Tesla’s latest trading price.