Tesla’s (TSLA) capital expenditures are expected to range between $6 billion and $8 billion this year and each of the next two years. Tesla indicates its plan to ramp up new products, including an iteration of the Megapack, the company’s powerful storage battery. Reportedly, Tesla has reduced its stake in Bitcoin (BTC-USD) holdings in the second quarter.

Tesla Hikes Capital Expenditure

The electric vehicle giant also intends to ramp up manufacturing facilities in three continents as it also works on new battery cell technologies.

While the company intends to spend up to $8 billion, the pace of capital spending will vary depending on the overall priority of projects. According to Bloomberg, the company had initially planned to spend between $5 billion and $7 billion on ramping up manufacturing and other items.

The regulatory filing, however, indicates that higher capital spending is due to increased cash flow generation. In addition, Tesla is also benefiting from better capital management.

In response to Chief Executive Officer (CEO) Elon Musk’s warning of an unstable economic environment amid recession fears, capital spending has soared. The automaker has already laid off hundreds of workers and shuttered a facility in California.

Tesla’s Declining Bitcoin Holdings and Value

According to Bloomberg, Tesla has also disclosed a $170 million impairment charge in the first half of the year related to the carrying value of its Bitcoin holdings. It also recorded $64 million in gains from sales of certain Bitcoin holdings.

The Wall Street Journal (WSJ) reported that Tesla sold $936 million worth of Bitcoin holdings in the second quarter as it sought to bolster its cash positions. It has already offloaded 75% of its $1.5 billion initial Bitcoin position made in the first quarter of 2021.

Wall Street is Optimistic about Tesla

The Street is optimistic about the stock, with a Moderate Buy consensus rating, based on 18 Buys, six Holds, and seven Sells. The average Tesla price target of $872.28 implies 8.32% upside potential from current levels.

Bullish Bloggers’ Opinion

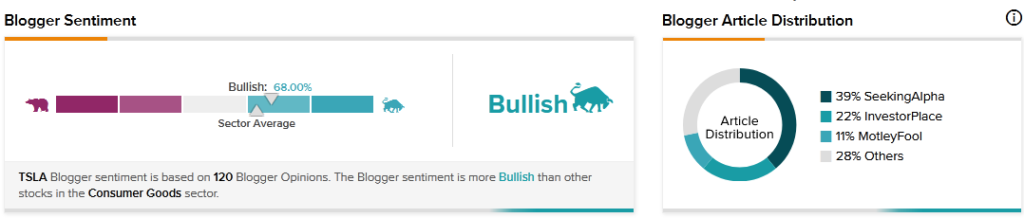

TipRanks data shows that financial bloggers’ opinions are 68% Bullish on TSLA, compared to a sector average of 63%.

Key Takeaway for Investors

Tesla’s increase in capital expenditures affirms that the company is doing much better despite a challenging business environment characterized by inflationary pressures and supply chain issues.

Read the full Disclosure.