The global Electric Vehicle manufacturer Tesla, Inc. (TSLA) seems to have nearly sold out the Model Y Long Range variant in Q3 based on recent registration figures, as per Teslarati. Shares rose 1.3% to close at $617.69 on June 14.

The earliest possible delivery date for the Model Y Long Range variant has been extended to September, which is the end of the company’s third quarter of FY2021.

Tesla’s all-electric crossover Model Y has already proven to be more popular than the all-electric Model 3 sedan in markets such as China and California. (See Tesla stock analysis on TipRanks)

The overwhelming demand for the Model Y has led to a price hike of $3,500 so far this year, despite the company cutting the cost of the car considerably in February.

Tesla has also made several alterations to the Model Y this year, including removing a lumbar-support option in the passenger’s seat and the removal of radar equipment in both the Model Y and Model 3, as a means to progress towards the company’s Full Self-Driving ambitions.

During the company’s Q1 2021 Earnings Call, CEO Elon Musk said, “When it comes to Model Y, we think Model Y will be the best-selling car or vehicle of any kind in the world and probably next year… I’d say more likely than not, that in 2022, Model Y is the best-selling car or truck of any kind in the world.”

With the company already selling out of its Q2 production volumes in early May, Tesla has been on a rampage, trying to scale up manufacturing capabilities for all of its vehicles, with Model Y being the prime focus as it expands geographically.

Yesterday, Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating on the stock with a price target of $820, implying 32.8% upside potential to current levels.

In his latest Global EV report, Rakesh stated, “We believe TSLA remains the battery electric vehicle (BEV) market share leader globally, with ~24% market share…While we expect to see emerging competition for TSLA in the coming quarters with the VW ID.4, Mercedes EQS, and Mustang Mach-E, (among others), we would note the complexity and investment required to successfully ramp and integrate battery technology and new EV platforms.”

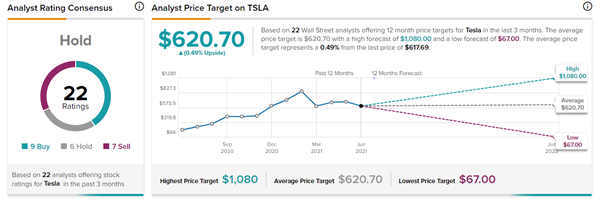

The stock has a Hold consensus rating based on 9 Buys, 6 Holds, and 7 Sells. The TSLA average analyst price target of $620.70 implies that shares are almost fully valued at current levels.

Related News:

General Electric and Safran to Develop New Jet Engine, Extend CFM Partnership to 2050

Magnachip Receives Hostile Bid from Cornucopia; Shares Jump 12%

Nvidia Buys DeepMap, Enhance Autonomous Vehicle Mapping Precision