The Street expects Tesla (TSLA) to report 200,000 car deliveries in Q2 against 184,800 delivered in Q1. A survey by Bloomberg on 11 analysts signals 204,160 car deliveries for the quarter.

Tesla’s quarterly delivery reports are becoming a big deal as the market uses the numbers to weigh the demand for electric vehicles (EV) in the market. However, tight inventory and a global chip shortage have aroused concerns around automakers’ ability to ramp up car production.

Bloomberg reports that Tesla might have shrugged off the headwinds by managing inventory and matching output to meet EV demand in the second quarter. (See TSLA stock chart on TipRanks)

“Tesla has dealt with a major chip shortage and logistics/freight issues (like other automakers) which could have translated into roughly 10K cars currently in transit globally… Deliveries of Model 3/Y in the range of 195,000 “would be viewed as positive this quarter,” said Wedbush analyst Daniel Ives.

The U.S. is one of Tesla’s biggest markets, where it also operates plants that develop the Model S and Model X. China also accounts for a big share of its total EV sales and develops the Model 3 and Model Y from a plant in Shanghai, China.

The strength of Q2 deliveries out of China will significantly sway Tesla’s sentiments in the market.

Deutsche Bank analyst Emmanuel Rosner recently reiterated a Buy rating on the stock and a $900 price target, implying 32.8% upside potential to current levels.

For Q2, Rosner lowered his Tesla car deliveries estimate to 200,000 from 207,000 on the production of 205,000 units. According to the analyst, the cut is a result of softer China volumes. Rosner also cut his Q2 revenue estimate to $11.1 billion from $11.6 billion, citing the impact of lower volumes.

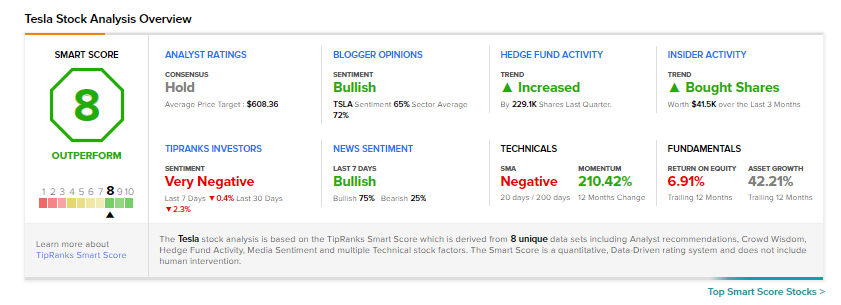

Consensus among analysts is a Hold based on 10 Buys, 7 Holds, and 7 Sells. The average Tesla price target of $608.36 implies 10.26% downside potential to current levels.

TSLA scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Amazon Creates R&D Center for Amazon Scout in Finland

Accenture Snaps Up CS Technology; Shares Rise

Olin Inks Deal with ASHTA Chemicals; Street Sees 27% Upside