The Elon Musk-led electric vehicle maker Tesla (TSLA) is considering splitting its stock again after doing so in 2020. Tesla stock jumped almost 5% to trade above $1,060 during premarket session on March 28, after the company revealed the new stock-split plan.

In a SEC filing, Tesla says it will ask shareholders at its 2022 annual meeting to approve an increase in the number of the company’s authorized shares. Getting the approval would enable the company to proceed with the stock split, which it says would be in the form of a stock dividend to shareholders.

The management proposed the increase in the number of shares to facilitate the split and the board has endorsed the plan. Tesla held its 2021 annual meeting in October, but it has not revealed the date for the 2022 meeting.

What Does Tesla’s Stock Split Mean?

In August 2020, Tesla implemented a five-for-one stock split, which saw the share price drop to about $500 apiece from more than $2,000. A split can make a stock more affordable for retail investors, which could in turn generate more demand for the stock and cause it to appreciate in value. Tesla stock has more than doubled since the last split.

Wall Street’s Take

On March 28, RBC Capital analyst Joseph Spak maintained a Hold rating on Tesla with a price target of $1,045, which indicates 3.4% upside potential. Spak believes Tesla’s Q1 2022 delivery numbers will top consensus expectations. The analyst estimates Tesla delivered 325,500 cars in the quarter, which would be 76% more than it delivered in the same period the previous year and 6% above consensus estimates.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 16 Buys, five Holds, and six Sells. The average Tesla price target of $1,063.88 implies 5.3% upside potential to current levels. Shares have declined 16% year-to-date.

Blogger Opinions:

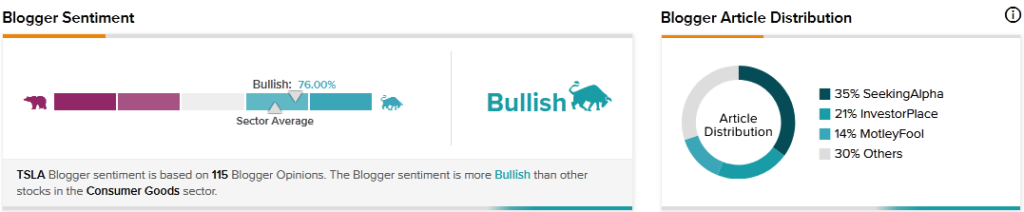

TipRanks data shows that financial blogger opinions are 76% Bullish on TSLA, compared to a sector average of 69%.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

BP to Invest £1B to Triple Its UK EV Charging Network

HP to Snap Up Plantronics for $3.3B; Shares Slip 1.5% Pre-Market

Axsome Rises 2.1% on Acquisition of Sunosi from Jazz Pharmaceuticals